How to Choose the Most Suitable Personal Loan Lender?

A personal loan is presented by banks, Loan associations, and online moneylenders. There are a few choices accessible, yet not all merit considering. All the more significantly, a few moneylenders offer more captivating Personal Loan items than others.

Online Loan specialists will likewise offer candidates various rates relying upon the expected borrower’s monetary circumstance.

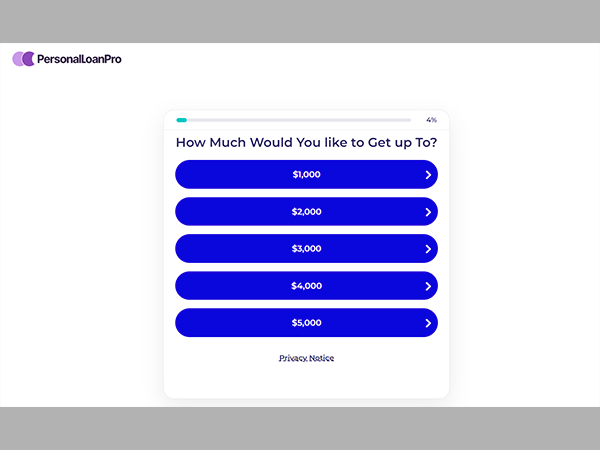

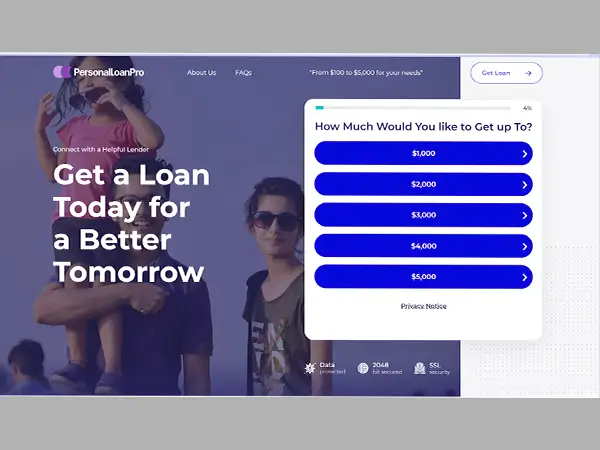

To find the best loan for you, you need to look around and assess the kinds of loans every moneylender offers. Most importantly visit Personal Loan Pro to get a personal loan. From Personal Loan Pro, you can find many reliable lenders from its platform and get a personal loan quickly.

What Does It Mean to Search for Loan Specialists?

It would help if you looked around with a few banks to guarantee you get the best arrangement on a personal loan. In that case, you could get an essentially higher financing cost than you’d fit the bill for somewhere else.

You could get a regularly scheduled installment that extends your financial plan slightly, and you could pay a few hundred or thousands of dollars more in revenue over the existence of the Loan.

Why Pick a Personal Loan?

Personal loans have fixed terms and regularly scheduled installments. Suppose you settle for a Loan with a principal loan specialist like Personal Loan Pro, you can plan to apply for a personal loan to fulfill your requirements.

You can get just the cash you want to eliminate any impulse to overspend. For borrowers with phenomenal Loans, the best private advance rates may be essentially not even the best charge card rates.

Borrowers with not exactly excellent Loans might also have the option to track down a Personal advance yet at perhaps higher loan fees. Not confident about where you stand? These are the two best sites for getting your free financial assessment.

Regardless, it pays to search around.

Elements to Assist You With Picking the Perfect Personal Loan

Before you secure a particular Personal Loan, it is fundamental that you direct nitty gritty exploration. Here are the main things that you want to consider:

Advance Sum

Preceding making a move on your choice to benefit from a Personal Loan, one of the essential elements includes concluding the Loan sum you wish to get.

Contingent upon the requirement for reserves, you should fix the ideal Loan sum and afterward continue to ascertain the regularly scheduled payment (EMI) commitments given the advance sum and the residency for which you take the advance.

Loan Reimbursement Position

When you take a Loan, it is prompted that you reimburse the honor at the earliest possible time. Moneylenders with limited capacity to focus on reimbursement would typically request higher EMIs, inferable from the lesser number of portions.

Defaulting on advance reimbursement could imprint your FICO rating, deterring moneylenders from endorsing Loans to you later on. So, while you might be hoping to become obligation free soon, it’s critical to check your reimbursement limit and go with a Loan residency that turns out best for you.

Loan Specialists

A personal advance is the most well-known item presented by banks and monetary establishments. Generally, we’re overwhelmed with calls and instant messages offering us Personal Loans at appealing loan fees and terms.

With plenty of choices to browse, choosing the right moneylender can overpower most definitely. In such cases, you must take care of any outstanding concerns to avoid succumbing to fraudsters and Loan traps.

Also, Read: How Unemployed People Can Apply for One of Those Online Loans Available?

FICO Rating

A FICO rating or a CIBIL score is a vital mark of your qualification for a Personal Loan. Before you find a way to profit from a personal Loan, you really must check your Loan or CIBIL score.

Financing Costs

You might have a heap of loan specialists approaches you with substantial and barely low-financing costs. As appealing as this deal may be, remember that when you decide on such a low-financing cost loan, you might wind up paying more because of numerous other preposterous Loan terms.

EMI Computations

Before you take a Loan, it is fundamental that you get familiar with the course of EMI computation.

Realizing this will assist you with understanding your ability to reimburse the advance on time. With choices like no-cost EMI and high-level EMI on the lookout, having a reasonable comprehension of how these EMIs are determined is essential to guarantee that you try not to pay more than you need to.

Start Expenses

A few moneylenders charge start expenses for Personal Loans. The start charge is a decent sum that should be paid once the Loan application is shipped off the moneylender or when the advance application has been confirmed.

Knowing the rates at which various loan specialists charge the beginning expenses will assist you with settling on the ideal choice and avoiding high start charges.

Deficiency and Prepayment Charges

One more arrangement of expenses you should be careful about is the dispossession and prepayment charges. These charges come into the image assuming the borrower intends to settle their Loan before their advance residency.

While certain banks might decide not to charge any abandonment expenses, most banks charge any place somewhere in the range of 2% and 5% of the equilibrium sum.

Different Charges

Look into these charges on the moneylender’s site or Loan application structures. Knowing this large number of extra expenses and costs will assist you with understanding precisely the amount you will be charged during the time spent taking a Personal Loan.

Consider Your Ongoing Liabilities

Before applying for any advance, you want to consider your current obligation and liabilities. There might be occurrences when you, as of now, have a continuous advancement that the borrower should reimburse or Visa charges that they should settle.

It’s vital to consider these commitments and work out your debt related to salary after taxes.

What Variables to Use to Assess Banks?

While looking at Personal Loan choices, you need to assess the bank’s standing alongside the loan costs and expenses they charge. It’s likewise critical to consider the loan presented as some may not work for you.

Advance APRs

The loan cost, or cost of getting, is not entirely set in stone by your financial assessment and advance term. Banks will quite often promote a low-financing fee to tempt clients. In any case, the least rates are commonly saved for clients with excellent Loans. A decent FICO rating could likewise get you a serious interest.

Expenses

Does the moneylender charge application, beginning, or prepayment expenses?

Depending upon the amount you acquire, these expenses could add up rather rapidly, regardless of whether they’re moved into the advance.

Client Experience

What are the busy times for the moneylenders you’re thinking about? Could it be said that they are accessible by telephone, email, or talk? Could you, at any point, visit an actual area to get help?

These are only a few inquiries to consider as you assess moneylenders to measure on the off chance, that they’re effectively open.

Main Concern

Remembering your monetary objectives, you likewise might need to take a gander at the believability of the moneylender and the nature of their client care before continuing to apply for the personal loan.

While Personal Loans are accessible in abundance, making do with excellent personal Loans requires a lot of examination on the borrower’s part.

Next, Read: What You Should Know About Loan App Development

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…