Paying Off Personal Loans Early: Pros and Cons to Consider

Key Takeaways

- Early loan payments can save you money on interest and also boosts your credit score.

- You can also make an extra payment each month to reduce debt.

- Some loans come with prepayment penalties, which can result in additional costs.

- Consider your expenses and other financial goals before making the payment.

Just as every coin has two sides, so does the decision to pay off personal loans no origination fee. It can be an attractive idea, bringing a sense of financial freedom, but better moves are possible.

This article aims to provide a clear and balanced view of the advantages and disadvantages of early loan repayment.

The Advantages of Early Loan Repayment

Firstly, look at the sunny side of early repayment. Imagine a world with no mortgage repayments hanging over your head, where you can spend your money without a recurring monthly financial obligation. Having a debt can be stressful and by paying it off before time, you reduce one source of stress in your life. Sounds appealing.

The immediate advantage of early credit payment is the significant reduction or even elimination of interest costs. Like turning off a dripping faucet, it halts the slow but steady drain of money that is the interest on your loan. Over time, this can equate to substantial savings, increasing financial health.

The longer it takes you to pay it back, the higher the interest rate will be. You can save a lot of money on interest by paying it off as soon as possible.

Moreover, repaying it quickly can lead to a boost in your credit score. Akin to a student who consistently delivers assignments before the due date, early remuneration portrays you as a responsible borrower, improving your creditworthiness. A good credit score can also help you in qualifying for lower interest rates on future loans.

This opens the door to better financial opportunities in the future.

There are some tips that you can follow for the same. This includes making a budget to track your expenses and automating your payments to avoid late fees. Small steps lead to a big change. You can make extra payments each month, if possible. This can make a big difference over time.

Do You Know?

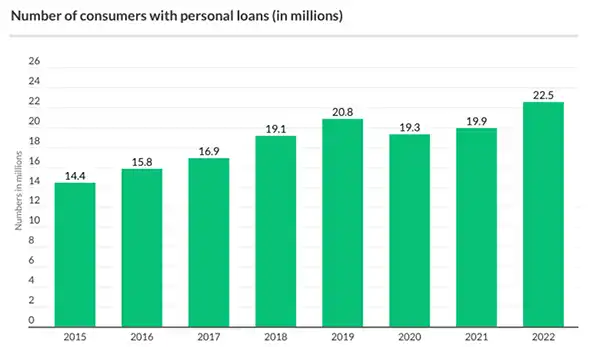

As of the fourth quarter of 2022, Americans have personal loan debt totaling $222 billion.

The Disadvantages of Early Loan Repayment

Despite the seemingly attractive benefits, early mortgage repayment is not all roses. It can sometimes feel like stepping on thorns hidden beneath the petals.

Some loans come with prepayment penalties and additional costs for paying off the credit ahead of schedule. The amount of penalty depends on the terms of your loan. Usually, a prepayment penalty is expressed as a percentage of the remaining total loan or as the interest for a predetermined number of months.

Imagine being a marathon runner penalized for finishing the race too soon. It’s an unfortunate and unexpected cost that could potentially outweigh the benefits of early payment.

Moreover, paying off it before time could leave you with limited cash flow. Consider it as having a large meal at a fancy restaurant but then finding yourself with insufficient money for the bus ride home. There are other better things to focus on first like making your regular payments on time.

If a financial emergency arises, having tied up your extra funds in early loan repayment could make you sticky.

Besides, it also affects negatively your credit score. Your payment history strongly influences your credit score. Long-term on-time payment history is good for it. If you are someone who is building their credit, paying off a loan before time could mean losing out on months of establishing on-time payments.

It is observed that lenders typically favor longer-history credit.

Things to Consider Before Making Early Repayments

Before making a decision, borrowers should consider a few key factors. One must look at their entire financial picture like a puzzle; each piece must fit perfectly for the complete image to make sense.

It’s vital to consider whether other debts with higher interest rates should be paid off first. It’s like choosing to fix the leaky roof before painting the house. One should also consider their savings and whether they have an emergency fund.

As Lantern by SoFi suggests, “Understanding all the costs associated with taking out a personal loan can help you compare them and find one that fits your needs, budget, and repayment timeline at the lowest cost possible.”

If you have enough money in your budget to pay your expenses and maintain an emergency fund, apart from paying off your loan, it can lead to financial security. Look out for the prepayment penalties or if you have other high-interest debt before thinking about making early repayments.

How to Approach Early Loan Repayment

If you decide to go ahead with early loan repayment, there are specific steps you can take to ensure a smooth process. Like a well-planned road trip, you must carefully chart your path.

Firstly, reach out to your lender and confirm whether there are any prepayment penalties. Secondly, decide whether to make larger monthly or lump sum payments. Finally, revise your budget to accommodate this change in your financial planning.

Paying off personal loans with no origination fee is a significant financial decision with pros and cons. It’s like taking a shortcut or the scenic route on a journey – both have unique benefits and pitfalls. Considering all aspects and making an informed decision, can ensure that you take the route that best suits your financial landscape.

In conclusion, paying your debt early has both pros and cons, depending on the situation. Examine all the cases like other financial debt, and expenses before making any decision. Check out the prepayment penalties if any or discuss it with the experts, so that there is no additional cost.

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Simplify Your Finances: A Guide to Direct Deposit…