Enhancing Business Finance: The Power of Tax Relief Measures

The government of the United States collected 425 billion U.S. dollars as tax revenue from corporations in 2022. According to the predictions of Statista, this number will constantly increase in the coming years.

Paying taxes is compulsory for all entrepreneurs and business owners on the revenue generated by their ventures. Individuals and enterprises who are inside the tax bracket should consider this as a responsibility rather than a burden because the development of the nation depends on taxes.

You should equally focus on overpaying your taxes as with underpaying. An effective tax planning strategy can help you save time and reduce tax liabilities. In this article, we will get familiar with the top 5 tax relief measures that will surely decrease your tax liabilities.

Top 5 Tax Relief Measures

Several provisions of the government allow taxpayers to make investments from taxable money and cut off the part of taxation. Apart from that, there are several more measures you can use to reduce the taxable amount legally. Here are the Top 5 measures for tax relief:

Capital Allowances Uncovered

You must have heard from your CA about What are capital allowances and how they help in tax deduction. In simple terms, In the process of capital allowance, companies can claim certain expenses and costs of assets from the profit to reduce the taxable revenue.

Capital allowance can be claimed on the following assets according to a fixed rate:

- Motor vehicles

- Commercial buildings

- Plant and Machinery

- Computer software

- Special intangible assets

- Retail and shopping centers

When enterprises acquire or improve property, they can claim capital allowances on some assets related to building. The main benefit of capital allowance for businesses is that it increases their cash flow.

This cash can be used in other operations later on. It reduces the operating cost of the business and increases profitability. Perks of capital allowance motivate organizations to invest in new technologies and innovations.

Identifying Eligible Assets and Expenditures

Identification of assets and expenditures that are eligible for tax-saving measures is necessary. Because you can implement the provisions and measures of tax relief only when you know the eligible components.

As discussed earlier, you can identify the parts of your newly acquired and improved assets in the building to take advantage of tax relief provisions and increase the cash flow of the business.

On the other hand, you can drastically decrease the taxable amount by identifying the appropriate expenditures under the provision of tax deductions. Here are some of the main expenditures eligible for tax deduction.

- Cost of research and development.

- Employee training expenses.

- Expenses on eco-friendly technology.

You must be knowledgeable about the tax laws and regulations to effectively identify the eligible assets and expenditures for tax deduction. You can also get help from an industry professional.

An experienced and knowledgeable tax expert will not only help you identify the eligible resources but also ensure that your business takes full advantage of tax relief policies and measures.

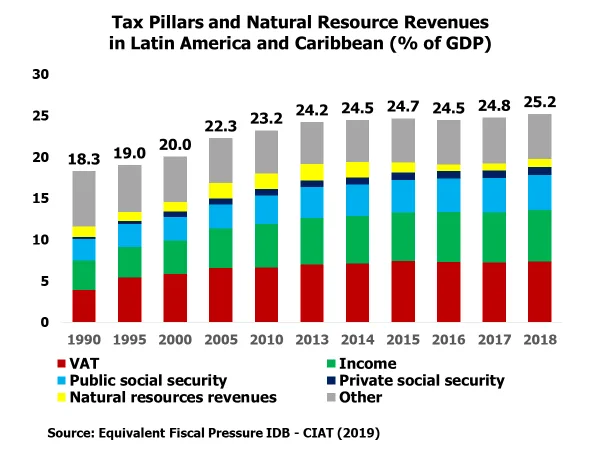

Interesting Fact

The Above graph shows the tax pillars and natural resource revenue in Latin America and the Caribbean (% of GDP)

Innovative Approaches To Tax Relief

Conventional approaches to tax saving are not as effective as they were in previous years. Because of this, innovative approaches to reducing taxable amounts are getting popular rapidly.

Targeted tax incentives for specific industries and regions are the one method among all innovative approaches. The government can encourage investments and innovations in a specified industry by reducing the tax ratios.

It will not only help taxpayers but also drive growth in the desired sector of the economy. Targeted tax incentives provide immediate perks to business owners and support long-term development.

Another innovative approach to tax relief can be to provide tax credits and incentives to encourage research and development industries.

These innovative approaches reduce the tax liability of entrepreneurs and help them work on innovative projects.

Donate For Worthy Causes:

Businesses can use tax-deductible donations to promote worthy causes in society. This measure will not only give you financial benefits but also help you fulfill social responsibilities.

Tax-deductible donations are the sum of goods and money businesses donate to charity. It also helps in the unofficial marketing of your brand. You can sponsor charitable events and activities to establish your brand name on the local and national levels.

Once you start donating to a social cause your competitors are most likely to do the same for similar activities which will ultimately help society.

NGOs and other organizations working for a social cause get huge benefits when any business donates them an amount.

It is advised to always keep a record of receipts, pay stubs, or bank records to show the legitimacy of donations whenever required.

Buy Vehicles:

Buying vehicles for business use can deduct your taxable income. You can analyze how many times you need vehicles for client meetings and other organizational operations.

Based on requirements, you can buy motor vehicles for daily use. If you are using the car partially or completely for business, you can claim a business vehicle tax deduction on it.

Some people use the same vehicles for personal and business use, they can claim the percentage of use for business in this condition. Following are the few conditions of business use of vehicles:

- For client meetings

- Meeting with suppliers

- Delivering items to customers.

- Meeting accountants and lawyers.

Wrap-Up

Tax relief measures help business owners to reduce the tax burden legally. Entrepreneurs can opt for these measures to deduct taxable profits and invest that money somewhere else.

Nowadays, various online tax management tools are available, through which you can streamline your tax filing process. Hiring a tax expert will help you benefit from all the ways to reduce tax.

A knowledgeable and experienced tax expert will provide you with different ways to manage profits and reduce taxable amounts.

In this post, we discussed the 5 most effective measures of tax relief. If you find this article helpful, share it with your fellow business owners and entrepreneurs.

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…

Simplify Your Finances: A Guide to Direct Deposit…