Dive Into the Oil Profits by Investing in the Oil Trade Today!

Key Takeaways

- Oil Trading is a very wise decision to utilize a consistent and fair asset of the world’s economy.

- It is a finite but stable asset that makes it more reliable for investment.

- There are numerous factors that determine its price in the market, such as demand, supply, market speculation, political concerns, and many more.

It’s true that trading has become very convenient and accessible nowadays, thanks to advanced technology and brokers, too. Now, anyone working with Wall Street or with Fast Foods is able to make an investment in oil trading. Although it is an undeniable fact that it fuels the economy, people still don’t know how to utilize it.

In fact, oil is certainly a fair and consistent asset. Since the oilprofit.app is designed in a way to assist new traders, it also helps to bypass the traditional approaches to trade with it.

Why Should One Choose to Trade in Oil?

The answer is very straight: It is one of the most widely used sources on the planet. The world’s 40% of energy consumption is oil. So, whether it is a country, economy, or monarchy, it powers all of them.

Even though people are considering renewable sources and green energy as a priority, it is irreplaceable. That’s why, undoubtedly, there will always be interested people in this resource.

Furthermore, it is good to consider that the prices might go up. This is because it is a scarce resource, which simply means if the demand goes down, the supply will follow up the same.

🤔 Do you know? Countries such as Saudi Arabia and the United States are built on oil economies.

What Does the Oil Trading Mean?

It is the process of buying and selling different types of assets that can be oil or linked to it that have the objective of making a profit out of it. There are various ways to trade in it, such as,

- Spot price:- Here, the traders deal with the stock on the stock rather than saving it for the future.

- Oil futures:- These are the contracts under which the amount of the oil gets exchanged on the set date and the set time.

- Oil options:- These are quite similar to the future contracts. But there are no obligations to trade when you don’t want to. well, you need to be careful because your maximum profit can lead to a risk if the market goes against you.

(** In the oil options, the selling options have the potential to generate income in the quiet markets. But you have to be careful when the market goes against you.**)

Discover Oil Trading as a Liquid Gold

One of the biggest reasons to invest in it is due to its stability. Also, what the pandemic and Ukraine war have taught us is that it is a locomotive for the economy.

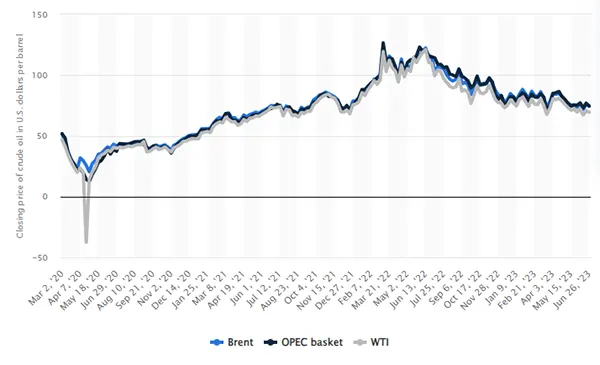

According to Statista, the Brent Crude Oil price stood at $74.35 per barrel, WTI oil at $69.37, and the OPEC basket at 74.65 US Dollars, and these three are the benchmarks considered for reference for the oil and gasoline prices.

In fact, it has successfully proven itself, due to which, presently, many traders prefer investing in it over other resources.

How Does the Prices of Crude Oil are Determined?

It’s just like any other commodity whose price gets impacted by the supply and the demands along with the market sentiment and inventories. Besides this, you must know that it is traded according to the future contracts. Also, one of the principal determinants of its prices is market speculation.

Traders often try to conclude about the consumer demands, and the production output is likely to occur in upcoming months. Furthermore, the spot prices do differ from the future prices as they reflect the current price of the commodity.

Is It Worthy to Invest in Oil Trade?

This is an obvious question that strikes our minds when the world is actively shifting towards green energy. But, it is necessary to understand that the shift is not away from the oil; in fact, it is actually because of it. Hence, it means that the game is still not over yet.

In fact, don’t forget that it is still the 40% contributor to the world’s energy consumption. Just think for a second why everyone is not running the Tesla cars. There must be a reason behind it.

Also, you probably know that it powers the engines of civilians and the military, bigger or smaller, which clearly justifies that there will be a regular demand for it. But, as it’s a finite resource, once it’s gone, it’s gone forever. However, the more it gets consumed more its worth will increase.

Apart from these, experts also state that it is still going to rule for upcoming decades. Hence, it is understood that it is worth investing in unless and until the last drop is pulled out from the earth.

Oil Trading and Future

Well, we cannot ignore that despite being one of the biggest industries on the planet, oil has always been stuck with that outdated technology. But, with the rising awareness, new investors will start investing in this resource, too.

However, it is important to implement a new and strategic approach to it. This is because it is not like other assets, and assuming its behavior can be challenging. It will be a great decision to enjoy more positive returns.

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…

Simplify Your Finances: A Guide to Direct Deposit…