How Can Families Save More Without Compromising Their Lifestyle?

Your bank account starts running up before the salary of next month and you again failed to keep up with your promise to take your family on holidays.

Doesn’t sound pleasant, right?

But in a world where expenses are reluctantly rising, is it possible to save more money but don’t give up the fun stuff? It’s possible.

Saving money is like a game where you find creative ways to keep more cash while still having a blast.

One secret weapon in this game is a high yield checking account. It’s a cool way to grow your savings without cutting corners on your lifestyle.

In this article, we’ll explore some fun and smart ways to save as a family.

Create a Budget Together

Creating a budget is not as complicated as you make it, it’s a simple pattern to scrutinize where your money is going or should be spent.

However, you can think of making a budget like planning a family adventure, all you need to know is where you’re going and what you’ll need.

Gather around and talk about what you spend money on – everything from ice cream runs to those monthly bills.

Get your kids involved, too; it’s like a detective game where everyone helps to track down where the money goes.

Once you know where your cash is going, you can spot easy places to save, like maybe cutting down on ordering pizza every week.

Shop Smarter

Shopping smarter is like a treasure hunt as you hunt for deals, clip coupons, or buy things in bulk when it makes sense.

The kids should also be aware of how to compare prices and spot a good deal. It’s like a game where finding a lower price is a big win.

Also, think about second-hand stores or swapping items with friends. It’s like a fashion show with a twist – finding cool stuff at lower prices.

Likewise, there are a lot of ways to save money in grocery stores but it all should begin with a shopping list.

It frequently happens when we are on our way to pick up food and items, we fail to remember for what major thing we actually came out of our house.

And due to this, we end up carrying products that are either already available or not in use, and that’s where the grocery list plays a vital role.

Cut Unnecessary Expenses

Imagine that you are on a boat and because of the overload, your craft is drowning slowly.

Now, in such a situation, any smart person will prefer to throw out the stuff that is no longer required or necessary, and that’s what cutting unnecessary expenses is like.

Maybe skip that extra coffee shop visit or have a fun night at home instead of going out to the movies and nightclubs.

These small changes are like tiny drops in a bucket that add up to a big splash of savings over time.

Remember, there’s no better time than now to reduce unnecessary expenses and take a step forward to allocate the money where it is truly needed.

Use a High-Yield Checking Account

A high-yield account is like a superhero for your savings and a great place to stash your holiday spending money.

Opening and using this tool is relatively simple and it helps your money grow faster because of higher interest rates.

You can think of it as a magic pot where your money multiplies the longer it stays in.

By keeping your savings in this account, you’re earning more without having to do anything extra. It’s a super-easy way to boost your family’s saving power.

SoFi states, “Every high-yield checking account also comes with a savings account that has a 4.60% APY.”

Plan Fun, Low-Cost Activities

Saving money doesn’t mean you have to stop having fun, you can still keep yourself entertained and on budget.

All you need to do is find low-cost or free ways to have a blast e.g. you can go for a family bike ride, have a picnic in the park, budget-friendly camping trip, break out a board game, puzzle, or deck of cards, or do a movie marathon at home, and many more.

There’s no doubt that these activities are not only cheaper but can be more memorable than expensive outings.

Also, in this way, you not only save money but can actually bring your family closer with these shared experiences.

Major Statistic:

Total U.S. personal savings amounted to $802.1 billion as of April 2023. The personal savings rate (personal savings as a percentage of disposable personal income) was 4.1%.

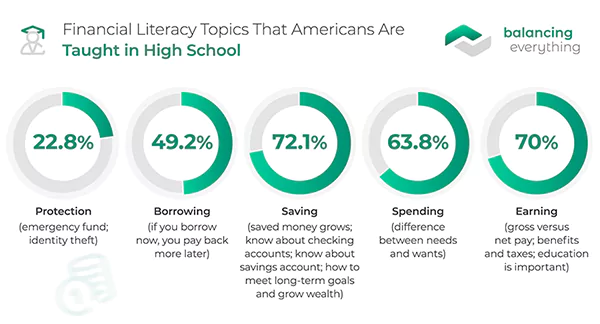

Educate Your Family on Financial Literacy

Financial Literacy is a growing concern and both parents and schools must address it.

You can make them involved in family budgeting decisions or can approach various other tools or software to inform them about how they can manage financial subjects.

Explain how saving money can help them all reach big goals, like a family vacation or that gaming console they’ve been eyeing.

Don’t make it a burden on them, rather teach the kids about money saving like giving them a secret map to treasure, so that they find joy in it.

Turn it into a fun project with charts or a savings tracker. It’s a great way for the whole family to learn about the value of money and work together towards common goals.

Conclusion

Saving money as a family can be a fun and rewarding adventure. It’s about being smart with your spending, getting creative with your activities, and using tools like a high-yield checking account to make your money work for you.

By working together, finding fun in saving, and teaching your kids the value of money, you can save more without feeling like you’re missing out on the good stuff.

So start your family’s saving adventure today and watch your savings grow while still enjoying life to the fullest!

Enhancing Business Finance: The Power of Tax Relief…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…

Simplify Your Finances: A Guide to Direct Deposit…