From Whiskey to Watches: The Fascinating Realm of Passion Investments

Key Takeaways

- Passion investments are considered a safe and more stable option than investing in Bitcoins.

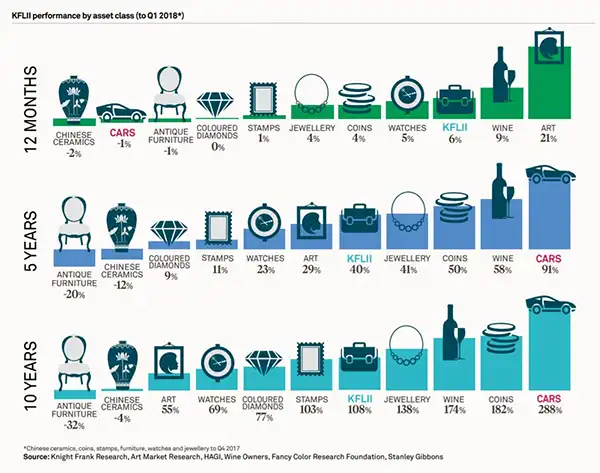

- KLFII is an index that tracks the performance of 10 asset classes, which include art, classic cars, coins, colored diamonds, furniture, handbags, jewelry, watches, wine, and whiskey.

- Cars and Whiskeys are the two investment options from which you can get the highest amount of ROI over a large period of time.

When it comes to investments, people usually go for cliché investment options like stocks, mutual funds, bonds, etc. Though they are brilliant options to grow your money exponentially, there are still some areas where people with a certain taste like to invest their money.

Various luxurious and rare commodities like whiskey bottles from exquisite brands, luxury watches, jewelry, etc., grab their special attention. The intent behind these investments can be both personal interest or financial security. ExpressVPN’s research reveals that the potential ROI of passion investments is considered a more stable option than investing in Bitcoins.

With this fact, you can get an idea of what potential this sector holds. So today, we are going to explore the world of luxury items and why the elite class of the planet is mad over those investments.

Diving Deeper into Passion Investments

Knight Frank Luxury Investment Index (KFLII) is the index that currently tracks 10 asset classes. These assets are art, classic cars, coins, colored diamonds, furniture, handbags, jewelry, watches, wine, and whiskey.

These commodities’ performance in the market is tracked by various sources, for example, AMR, Fancy Color Research Foundation, HAGI, Rare Whiskey 101, Wine Owners, and others.

As you can see in the tweet above, the growth rate of these luxury items is just phenomenal. That said, let us elaborate on these products to you and find out why they are embraced so much.

Is Investing in Furniture Worth It?

Collectors and enthusiasts are too willing to invest in furniture. But focusing on the numbers may not seem quite captivating. According to the data by KFLII published in 2018, collectible furniture only depreciates its value over the years.

As you can see, the more you collect antique furniture for a longer time, it will keep on depreciating its value by a significant percentage. Instead of furniture, investing in rare or antique coins can be a much better decision.

How About Investing in Watches?

Investing in luxury watches can be a good option. Numerous luxury watch brands like Rolex, Patek Philippe, Rado, Jacobs & Co., and many more, are renowned among watch collectors.

Just like you, there is a pool of investors with piles of banknotes, who are interested in getting one for themselves. If you manage to get your hands on one of the luxury watch products, you must keep it safe and sound for some years and notice its value grow in exponential numbers.

You can get extremely lucky if the manufacturing of your watch has stopped by the manufacturer. This way, the value can increase even more than 2x.

Invest in Whiskey and Wine with Passion

Collectors are mad about antique liquors. The more the drink is aged, the better it gets. An interesting fact is that the auction sales of whiskeys and liquors are estimating a 20% rise each year.

Even in the latest research of Knight Frank Luxury Index 2022, Whiskey and wine performed the best in 10-year % change. The number touched a record-breaking amount of 428% return in 10 years.

Therefore, if you are also considering investing in rare or antique liquors, it is advised to preserve it for a longer period of time so that you can get a brilliant ROI out of it.

An Artistic Investor will Invest in Art

Art is another area where the investors are in huge numbers and ready to place high bids in order to get their hands on them. Even in the data prepared by KFLII, art is performing far better than antique furniture and Chinese ceramics (even better than watches and jewelry in some cases).

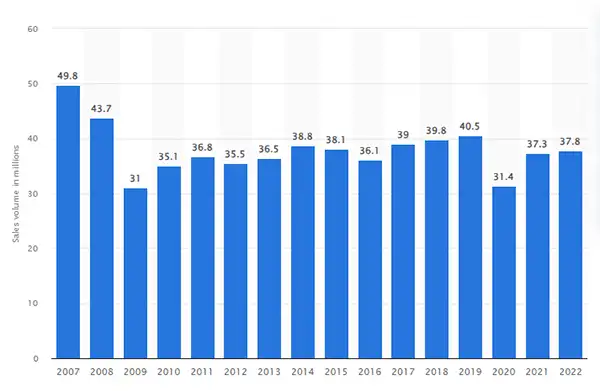

There are an endless number of surprising facts and crazy stories of how art gets sold for a sky-high price. As you can see in the data collected by Statista below, the volume of sales in art is calculated to be over 30 million in 2022.

Fact: In the auction at Christie’s in 2017, Leonardo da Vinci’s extraordinary and controversial art SALVATOR MUNDI was sold for a sky-high price of $450,300,000.

Moving on, you can also consider putting your money into classic or vintage cars.

Invest in Cars for Highest ROIs

People are crazy about cars. Auctioneers, museums, and many other organizations are mad about getting their cars auctioned at the maximum price. Cunning investors know how profitable car deals can be, and they thrive on getting classic and vintage models at any price possible.

Antique or rare classic cars tend to provide the most amount of ROI over a long period of time. The more you keep your car safe and well-maintained, the more it will give back to you in the future. This is what the best investment is called.

Wrapping Up

Stocks, bonds, mutual funds, crypto, etc., are very cliché options to get your money invested. No doubt, they hold huge potential to grow your money exponentially, but there are a lot of other options that you may consider exploring.

You can try passion investments. The term means getting your money invested into assets and commodities such as cars, art, whiskeys, jewelry, etc. Investors and collectors thrive over these investments as they know how much potential this industry holds in itself.

There are various examples, such as Leonardo da Vinci’s painting Salvator Mundi, Mercedes’ 1955 SL 300 coupe, and Craft Irish Whiskey Co’s. The Emerald Isle Collection is sold at a hefty price crossing over a million dollars. Only the real appreciator can notice the potential that these luxury items hold in their value.

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…

Simplify Your Finances: A Guide to Direct Deposit…