Simplifying Borrowing for Your New LLC: Financing Solutions Beyond Personal Credit

Key Takeaway

- Limited Liability Company(LLC) is simply like a small business loan that can assist you to cover day-to-day expenses.

- With a startup business credit card EIN-only approach, you can build your LLC’s credit history independently of your one.

- Business credit, like a treasure chest, comes with numerous benefits. A strong credit score can unlock favorable loan terms, lower interest rates, and greater borrowing power.

Entering the financial world with a new Limited Liability Company (LLC) can be intimidating, especially when the company’s needs stretch beyond the reach of personal credit. With a startup business credit cards EIN-only approach, it is possible to simplify borrowing and ensure your LLC starts its financial journey on the right foot. This article will break down this innovative solution and explain the concepts around it.

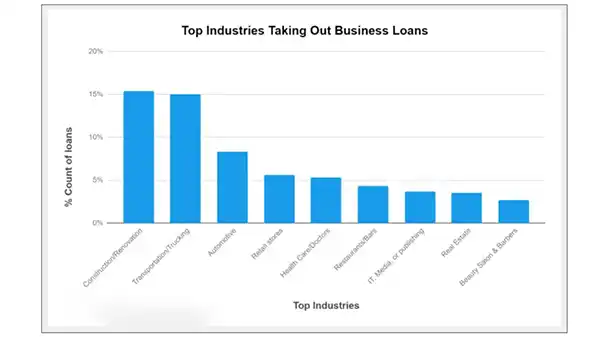

The below graph gives a vivid view of the businesses which are currently looking for urgent loans for fostering their growth.

What is an LLC Loan?

An LLC loan provides loan assistance to small businesses which are present as a limited liability company. They are quite similar to traditional banks and other online lenders and sometimes even backed by the U.S SBA (Small Business Administration). The fee and cost related to it can vary, for example, the LLC filing fee in Montana is $35 while in Massachusetts it’s $500.

Why are LLC Loans Used for?

LLC business loans use varies across the business’s needs. For example, Business debt consolidation, growth, startup, investment, and much more. Majorly the lender is going to inquire about the reason required for the LLC small business loans, some of which have been listed below.

- Business acquisition costs

- Franchise costs and fees

- Major one-time purchases

- Commercial real estate

- Expenses for business operations

- Marketing and advertising

What are the Types of LLC Loans?

The LLC loan type depends on a business’s worthiness in terms of credit score, its presence in the market, and the financial status of the company. Here are some of the most common types of LLC Loans to choose from.

- Equipment Loans

- SBA Loans

- Bank Loans

- Term Loans

- Invoice Factoring

- The business line of credit

- Merchant Cash Advances

Ways to Qualify for A LLC Loan

To qualify for an LLC Loan, one must take the following steps for improving the chances to get picked for this amazing opportunity. They can significantly boost your LLC loan qualification odds:-

- Take a look at the personal and business credit score.

- Prepare yourself to provide personal and business documents.

- Understand the eligibility guideline of the lender very carefully.

- Make a well-versed business plan, vividly showcasing how you will be using the loan

Do You Know: Some LLC Loans come with the collateral requirement, for example, real estate, and business equipment.

These were some of the pivotal ways one must consider for qualifying the LLC loan opportunity very well. Ahead explore the other ways to ease the borrowing process for your new LLC.

The Key to Independence: Why Go Beyond Personal Credit?

Imagine personal credit as a small boat that’s been doing a great job navigating calm rivers. But now, with your new LLC, you’re looking at venturing into the vast ocean of work finance. The small boat may not be enough, and investing in a larger vessel is time.

Using individual credit to finance any line of work can pose risks to your financial health, like sailing through turbulent waters. In contrast, business credit not only separates your personal and business finances but also opens up opportunities for larger amounts of capital. It’s like upgrading to a sturdy ship that can weather the storms of borrowing.

The EIN-Only Approach: A Powerful Beacon

The Employer Identification Number (EIN) can be likened to a lighthouse, guiding your LLC through the murky waters of related finance. With a startup business credit card EIN-only approach, you can build your LLC’s credit history independently of your one.

This means the company can access monetary resources based on its own monetary behavior, reducing the risks associated with using individual credit.

Expanding the Fleet: Diverse Financing Options

Stepping beyond personal credit can feel like assembling a fleet of vessels, each representing a different financing option. These financial tools can cater to varied needs and circumstances, from business credit cards and lines of credit to merchant cash advances and invoice factoring. It’s like having a diverse fleet of ships that can adapt to different sea conditions.

Each option has its advantages and can contribute to a well-rounded commercial strategy for your LLC.

As the article on Lantern by SoFi suggests, ‘Applying for small loans for businesses can be done with only an EIN, but it takes time to establish a business history in it.’

The Captain’s Skills: Responsible Financial Management

Even with a powerful beacon and a fleet of vessels, the captain’s skills navigate a ship through stormy seas. Prudent financial management is the cornerstone of successful borrowing. It’s about more than just making timely repayments; it’s about understanding your monetary needs, keeping track of expenses, and maintaining a positive cash flow.

These habits contribute to a strong credit score and establish your LLC’s reputation as a reliable borrower. Like a skilled captain charts the course for a successful voyage, responsible financial management ensures your commercial stability.

Reaping the Rewards: The Benefits of Business Credit

Business credit, like a treasure chest, comes with numerous benefits. A strong credit score can unlock favorable loan terms, lower interest rates, and greater borrowing power. It also instills confidence among suppliers and investors, leading to more opportunities and growth.

Moreover, having separate credit can protect your individual finances from potential work downturns.

The startup business credit cards EIN-only approach and a range of other financing solutions can simplify taking and establish a strong monetary foundation for you. When supported by responsible financial management, these strategies can unlock a treasure trove of opportunities and set your LLC on course for success.

Closing Thoughts

The article tried to explain the LLC loan qualification criteria, ways to ease the borrowing process for your new LLC, and much more. To boost the chances of qualifying the LLC opportunities, one can learn various tips and tricks for finding a new LLC loan.

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Paying Off Personal Loans Early: Pros and Cons…

Simplify Your Finances: A Guide to Direct Deposit…