Earning Passive Income with Liquidity Pools

Are you intrigued by the idea of making money with cryptocurrency not just sitting idle but actually working? Imagine a world where crypto assets generate a steady stream of income, almost like a high-tech savings account but with potentially higher returns.

Welcome to the world of liquidity pools—a hidden gem in the decentralized finance (DeFi) landscape that could turn crypto holdings into a passive income stream. Intrigued? Keep reading to unlock this untapped wealth in your crypto wallet.

What are Liquidity Pools?

If you’ve ever tried to trade or swap cryptocurrencies, you’ve probably encountered the term “liquidity.” In the simplest terms, it refers to how easily an asset can be converted into cash or another asset without affecting its market price.

Now, imagine a communal pot where various cryptocurrencies are stored to facilitate these trades—that’s a liquidity pool.

In the world of decentralized finance (DeFi), it plays a pivotal role. They act as the backbone of decentralized exchanges (DEXs), enabling users to trade cryptocurrencies directly without the need for an intermediary like a traditional exchange. This not only speeds up the trading process but also often results in lower fees

Did You Know?: The first projects that introduced liquidity pools were “Bancor”. But, they were popularized by Uniswap

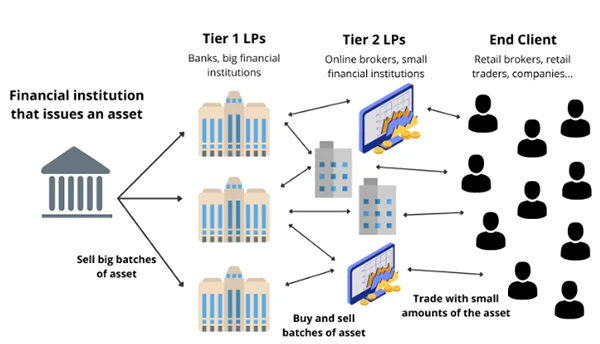

In the DeFi landscape, they are revolutionary because they democratize finance. Unlike traditional financial systems where large institutions often have the upper hand, they allow individual investors to become market makers. By contributing to it, you’re not just a passive participant in the market; you’re an active contributor who helps facilitate trades.

This is a game-changer, leveling the playing field and opening up opportunities for individual investors to earn from the trading fees that are usually reserved for big financial players.

Why Liquidity Pools are a Goldmine?

So, a few people are probably wondering, “That’s great, but how does this make me money?” Well, here’s the juicy part: They can be a lucrative source of passive income.

When one contributes cryptocurrencies to it, they become a Liquidity Provider (LP). As an LP, one will earn a portion of the trading fees generated by the pool.

Every time someone swaps one cryptocurrency for another using the pool, a small fee is charged, and that fee is distributed among all the LPs.

Think of it as a high-yield savings account but for cryptocurrencies.

The more one will contribute, the more they stand to earn. And the best part? The assets are still yours; they’re just working harder. It’s like having a side hustle that doesn’t require lifting a finger.

How Do Liquidity Pools Work?

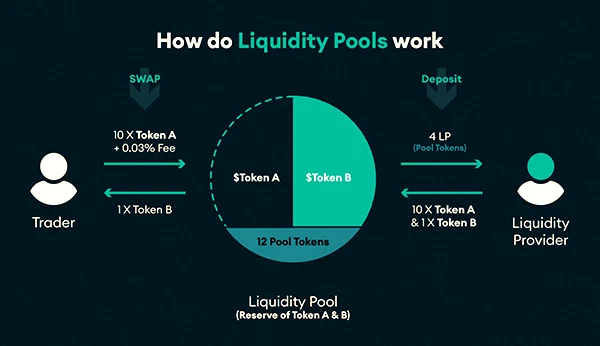

One might be wondering, “Okay, this sounds great, but how does it actually work?” Let’s break it down with a simple example. Imagine the contribution of Bitcoin (BTC) and Tether (USDT) to a liquidity pool.

The contributions are paired with those of other Liquidity Providers, creating a pool that holds both BTC and USDT. For example, trusted Bitcoin trading platforms like bitcoin.me offer this type of BTC/USDT liquidity pool.

When someone wants to trade BTC for USDT, they can do so using the pool. The pool uses a formula to determine the exchange rate, often based on the ratio of BTC to USDT in the pool. This is done by an Automated Market Maker (AMM), which automatically sets the price based on supply and demand.

After the trade is completed, a small fee is charged. This fee is then distributed among all the Liquidity Providers, including you, based on the proportion of contribution to the pool. So, the more the contribution is, the larger the slice of the fee pie which makes Bitcoin worth investing.

The Role of Liquidity Providers

So, you’re interested in becoming a Liquidity Provider, but what does that actually entail? As a Liquidity Provider, or LP for short, one is essentially a cornerstone of the liquidity pool. Contribute assets to the pool, like BTC and USDT, and in return, one will earn a share of the trading fees generated by the pool.

Do You Know?: The expression “Total value Locked (TVL)” is paramount if talking about Liquidity Pools. It is responsible for depicting the token’s value that is locked among others in the same. According to TVL at DeFiLlama, the current TVL (08.01.2022) is at 233 billion USD and the growth is enduring.

The beauty of being an LP is that you’re not just a bystander in the crypto market; you’re an active participant. Every time someone makes a trade using the pool, a small fee is charged.

This fee is then divided among all the providers based on the size of their contributions. It’s a way to earn passive income while also contributing to the efficiency and fluidity of the crypto market.

Risks Involved

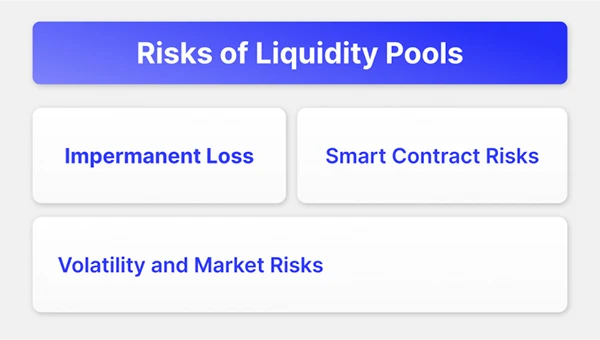

While becoming its provider can be a lucrative venture, it’s not without its risks. One of the most commonly discussed risks is impermanent loss.

It happens when the prices of the assets in the pool fluctuate, potentially leading to a situation where one might have been better off simply holding onto assets rather than contributing them to the pool.

Another risk to consider is the potential for smart contract vulnerabilities. While rare, these can lead to the loss of assets from the pool. Therefore, it’s necessary to choose a reputable platform and stay updated on any security audits or updates.

Despite these risks, many find that the rewards outweigh the challenges, especially when diligent research and risk mitigation strategies are applied. It’s all about understanding the landscape and making informed decisions.

5 Must-Know Tips to Get Started

Ready to dive in? Becoming a Liquidity Provider is simpler than one might think.

Here are some steps to navigate:

Choose a Reputable Platform

Research some platforms that offer liquidity pools and select one that aligns with investment goals.

Understand the Fees and Rewards

Before contributing, make sure to understand the fee structure and the rewards one will stand to earn.

Interesting Fact: After successfully analyzing Uniswap’s data, it is seen that high-fee pools attract only 58% of liquidity supply and merely execute 21% of trading volume.

Contribute to the Pool

After successfully making a choice, follow the platform’s instructions to contribute assets to it.

Monitor Your Investment

Keep an eye on contributions and the fees you’re earning. Most platforms offer dashboards for this purpose.

Stay Informed

Keep up to date with any updates or changes to the platform and the liquidity pool you’re participating in.

Conclusion

So, you’ve journeyed through the ins and outs of liquidity pools and now stand at the threshold of a new financial frontier. The question is, will you take the leap?

With the right knowledge and a dash of caution, one could transform their idle crypto into a bustling hub of activity, generating income even as you sleep.

It’s not just an investment; it’s a statement that an individual is ready to take control of their financial destiny. It is rich with opportunity—dare to dive in? For more insights and tips, be sure to check out Online Geeks.

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…

Simplify Your Finances: A Guide to Direct Deposit…