Investing in Education: Understanding Undergraduate Student Loans

The course to higher education can sometimes feel like navigating a dense forest, with the many options of financing being the tangled vines. One of the most effective tools to cut through this confusion is undergraduate student loans, a financial compass guiding aspiring scholars toward their academic dreams.

They usually cover your tuition fees and living expenses during your school life. If we talk about the United States, there are private ones such as from banks and then there are federal loans taken from the U.S. Department of Education. The difference lies in the limits, interest rates, etc.

Do You Know: The first student loans were offered to the children of Harvard University back in 1840.

The Lifeline of Undergraduate Student Loans

UG student loans can act as a lifeline for many, facilitating the pursuit of higher schooling. Just as a ladder helps reach higher ground, they provide the financial stepping stones for scholars to ascend to the height of their academic aspirations.

They bridge the gap between personal finances and the rising costs of college education. By accessing UG student mortgages, they can invest in their tuition and unlock a world of knowledge, skills, and career prospects that may have otherwise been out of reach.

Diving into the Details: The Structure of Student Loans

Understanding UG student loans is akin to understanding the rules of a complex game. The basic structure comprises the principal amount, interest rate, and repayment terms. Just as a player strategizes based on the game’s rules, they can plan their financial journey by comprehending these mortgage components. They can assess the funding needed to cover tuition, books, housing, and other education-related expenses.

By understanding the interest rate, sophomores can evaluate the cost of borrowing and its impact on their overall repayment. And by familiarizing themselves with these terms, they can select the option that best aligns with their financial circumstances and future goals.

The student is required to pay them in installments. As discussed, private loans are available through banks and online lenders, while Federal ones are available through the U.S. Department of Education. Most of the time they do not require a credit check and are lower than the private ones. However, there are downsides to it. If you are not able to pay the payment back after a particular day, the government can take all your tax refund, wages, or income.

“SoFi has got your back with a fee-less private student loan.” Founders by Stanford Business School alumni, their core value is to help people reach financial independence and fulfill their ambitions. Redeem and earn points to repay your student mortgage. The numbers below show how promising their services are.

They cover all the school-certified costs and also have no origination and late fees. SoFi also offers you the option that after they have confidence in your on-time payments, you can apply to release cosigners from the mortgage. You can visit their website to know more about their policies and team so that you can make an informed decision.

Navigating Repayment: Charting Your Financial Course

Picture steering a ship through a stormy sea. The repayment of UG student mortgages can feel similar. However, with various compensation plans available, they can customize their paying back journey as a captain directs their vessel, ensuring smooth sailing despite the challenging financial waves.

They can choose from options such as standard, income-driven, or graduated repayment, each offering different benefits and considerations. Federal loans have a six-month grace period, meaning you are not required to pay back the amount until six months after graduation.

If you are deciding to refinance your loan, it is pertinent to carefully evaluate your financial status and compare offers from various lenders. Consulting with a financial advisor or a counselor is always helpful to guide you through the process.

By exploring and understanding these options, they can chart a course that accommodates their financial situation and allows them to manage the payments effectively.

The Potential Pitfalls: Risks and Responsibilities

While UG student loans can be the golden ticket to higher education, they have their fair share of risks. It’s much like a road trip, where you need to anticipate potential hazards along the way. Understanding these risks – such as debt accumulation and impact on credit score – is pivotal in making informed borrowing decisions.

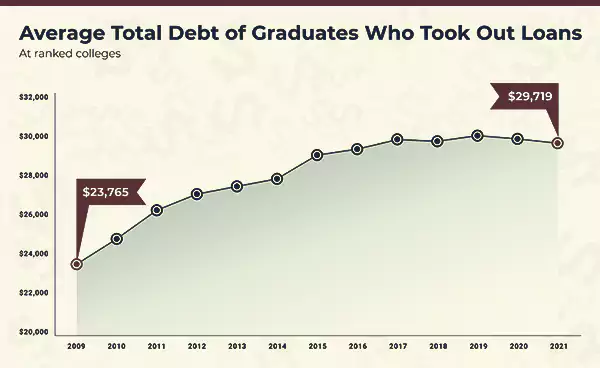

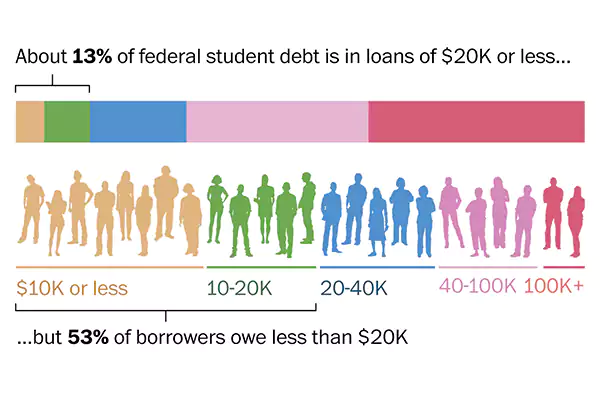

Do You Know – According to a report, people under the age of 34 are in debt of over $620 billion in student loans in mid-2019. It is vital to cross-check them to your expenses and borrow the amount as per the need.

Students must recognize their responsibilities as borrowers and proactively manage their mortgages. They should consider the potential challenges of repayment, including unforeseen circumstances like job loss or financial hardship, and have a plan in place to navigate these obstacles. You can always co-sign the debt as it makes the co-signer responsible for the loans if, in any case, the primary borrower is unable to pay it back.

Around 43.5 million Americans have taken Federal Student loans and there was an increase of one million borrowers per year from 2017 to 2022

The Bottom Line: A Worthy Investment

Despite the potential pitfalls, UG student loans are often a worthy investment. They are like the seeds sown today for tomorrow’s harvest – the harvest being the enriched future that a college education often guarantees. With careful planning and responsible borrowing, these mortgages can act as catalysts for personal and professional growth.

They are an invaluable tool for those aiming to scale the heights of higher schooling. While they come with their challenges and responsibilities, understanding their structure, strategizing repayments, and being aware of potential risks can make the journey much less intimidating. Remember, investing in education is often a stepping stone to a brighter future, and with the right planning, these loans can be your reliable companion on this rewarding journey.

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…