Know Everything About Rectification Request for Return Data Correction

Introduction

Once you have done the e-filing of your income tax return, your ITR goes to the income tax department. They start by processing your ITR and sending an intimation to you. This intimation or notification discloses whether you have filed the ITR correctly or if there are any mismatches.

In the intimation, they will also share their numbers in case of any potential mismatch. If there is a mismatch, and you are being asked to pay more, or there is a higher return, you can file for it.

When Should One Submit Rectification Request?

A taxpayer can submit it in case of any mistake during the ITR tax filing. The request can be made on the e-filing portal after the taxpayer receives an intimation issued under section 154 or 143(1).

These intimations are issued by CPC or the assessing officer whom the CPC may have transferred the rectification rights. It is also important to remember that you can only file it for ITRs that the CPC has already processed.

Remember that no rectification can be passed after four years from the end of the financial year. The period of 4 years will be counted from the date of the fresh order and not from the original order. A person who is filing the return or an income tax authority can rectify a mistake that is on the record.

Which Errors Can Be Corrected Using Rectification Requests?

At the time of e-filing of income tax returns, there is a possibility of entering any information incorrectly or forgetting to add specific particulars. Some examples include factual mistakes, clerical errors, mathematical errors, and forgetting some mandatory law elements that can be corrected under section 154.

Any matter that is not taken into consideration and decided in the appeal or revision may be rectified under Section 154. Keep in mind that it does not permit the correction of any issue that has already been examined and decided in any procedure by way of appeal or revision.

Once the intimation is received, the taxpayers can raise the rectification request for the below-mentioned errors. Remember, only the mistakes visible from the record can be rectified through the process:

Total Liability on Tax

It is the combined amount of taxes that you owe the IRS for your self-employment tax, capital gains tax, and any penalties or interest. If your payments are not according to the CPC, adjustment cancellation of any earlier demand, amendment of assessment order or intimation, or any variance in overall interest or tax computation are covered under this.

Gross Income

If at the time of e filing of income tax return, you have incorrectly or wrongly considered any of the below, you can raise the rectification request:

- Revenue chargeable mentioned incorrectly under any of the income heads

- Salary wage mismatched

- Carried-forward losses not mentioned

- Incorrect mention of present-year losses

- Re-calculation of total pay for subsequent years about depreciation or loss.

- Withdrawing assessment allowance

- Re-computation of deemed capital gains

- The amending assessment orders

Total Deductions

The following are considered as rectification for deductions:

- Any information of deductions entered incorrectly at the time of income tax return filing as per Chapter VI-A.

- AMT/AMTC or MAT/MATC not or partially allowed

- The amending assessment order for allowing the deduction for late remittance of any foreign exchange

Personal Information

- Requesting a tax at slab for partner’s information of returned e-filed

- The gender of the person who is paying the levy is wrongly mentioned or gender corrected or updated in the PAN system

- In case of reduction of taxes rate for domestic instead of non-domestic company

- The date of the original ITR filing is mentioned as outside the ITR filing date

- The reduced claim of income as governed by the Portuguese Civil Code

- In case of requesting of change of residential status

- If the taxpayer is a registered society as per Section 12A or a NRI, the income shown is not taxable in the return.

In the above-mentioned categories, all taxpayers are included. The income tax department has also stated that people should not use it for changes in address or bank account details in the ITR. In addition, all other mistakes that can be changed using the revised return should not be used in it.

Who Can File the Rectification Request?

People who receive the intimation from the assessing officer under section 143(1) or 154 can file the rectification request. Below are the people for your reference:

- All registered taxpayers

- ERIs who have added their client’s PAN

- All authorized representatives and signatories

Along with the rectification request, make sure that you include any necessary supporting documents that back-ups the errors being corrected. This could include receipts, invoices, or bank statements. After the acceptance of your appeal, the authority will provide instructions on how to proceed with the amendments. Once the revised data is reviewed by the authority and approved, it will replace the incorrect information in the original return.

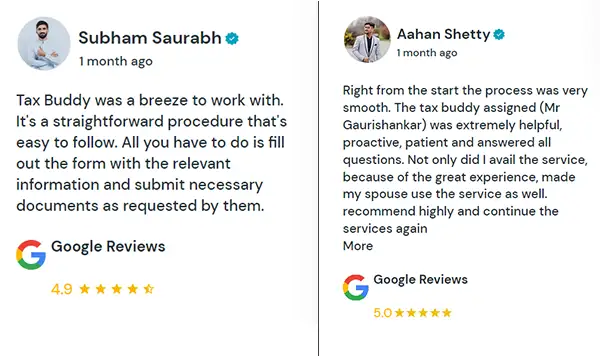

Many organizations help you with the correct filing of your income tax, and one such company is Taxbuddy. Founded in 2017, the well-curated team has over eight lakh users. They take to guarantee that if you use their services, you will not receive an intimation. Even if there is a probability, they will handle the situation without any additional cost. However, there exist no gaps as they leverage technological advances to bring in expert advice at a reasonable cost.

Below are some of the testimonials of their users, which show their remarkable world and service.

To Conclude

Nobody wants to receive an intimation from the Income Tax Department stating their information is mismatched or incorrect. But if it happens, there is nothing to worry about. The government has provisions through which taxpayers can file rectification requests only for the information mentioned in this article.

Enhancing Business Finance: The Power of Tax Relief…

How Can Families Save More Without Compromising Their…

Emerging Markets and Tech-Driven Growth: Investing in the…

The Future of Finance: Exploring Emerging Technologies and…

Earning Passive Income with Liquidity Pools

Best Practices for Developing an Account Planning Strategy

Dive Into the Oil Profits by Investing in…

Binary Options in Japan: How Bubinga Stands Out

From Whiskey to Watches: The Fascinating Realm of…

Simplifying Borrowing for Your New LLC: Financing Solutions…

Paying Off Personal Loans Early: Pros and Cons…