5 Best Cash Advance Apps: How to Make It till Payday

Cash advance apps let you borrow money quickly and easily when you need a cash flow injection. Most cash advance apps or loan apps simply allow you to make a direct deposit into your account before you receive your next paycheck, helping you to bridge short-term gaps in your finances.

If you’re on the brink of urgent bills or unexpected expenses, the best cash advance apps can prove invaluable in helping you to access the money you need before your next payday. They also make a sensible alternative to payday loans. But what is the best cash advance app for your unique situation? Keep reading to find out.

What is a Cash Advance App?

Instant cash advance apps are an inexpensive alternative to using payday lenders – and are particularly good if you only need to borrow very small amounts. Depending on the cash app you choose, they sometimes work a little differently from one another.

Either you’ll use your app’s cash advance function to wire yourself money instantly that you’ve already earned a few days before your next payday, or you’ll use the advance apps services to apply for paycheck advances or small personal loans – as some cash apps are effectively just loan apps in disguise.

How Do Cash Advance Apps Work with Your Bank Account?

In most instances, you will need to:

- Download your preferred app

- Link a same-brand banking account (or external account if possible)

- Apply for a cash advance within the app’s time and cash advance limits

- Receive instant cash advances into your linked checking account

Most apps will transfer your funds within 1 to 3 days, though you might need to pay hidden fees if you need the money sooner.

The 5 Best Cash Advance Apps Right Now

Maximum Loan: $250

Fees:

- $0.50 – $6 for superfast delivery (MoneyLion checking account customers)

- $2 – $8 for superfast delivery (non MoneyLion bank account)

- Tips are optional

Speed: 24 – 48 hours

APR: With a $100 direct deposit advance costing $8, plus a tip of $1 and repayment in 7 days, your APR would be 468.8%

Repayment: Automatically withdrawn from your account on the date the deposit money is expected.

About: MoneyLion’s all-in-one app allows you to manage your bank account, savings account, and investment accounts in the same place. MoneyLion checking account customers can access instant advances using the app’s “Instacash” and no interest rate or fees are charged unless you need your funds super fast.

Pros

- Get advances of up to $250

- Optional tip

- Credit checks are not compulsory

Cons

- Requires linked bank account

- Fees for faster advances

- Funding can be slow

Dave – Best for Repayment Date Flexibility

Maximum Loan: $500

Fees:

- $1 monthly membership fee

- $2 – $10 express fee for faster cash advances

- $3 to $14 fee to transfer to a non-Dave account

Speed: 1 – 3 business days (instant with express fee)

APR: A $100 instant advance within 7 days would incur a $7 express fee, $1 subscription fee, and $1 tip, as well as 468.8% APR.

Repayment: Your next payday is allocated for repayment by default.

About: Dave charges a little more than some of its competitors in the fee department and requires users to set up a Dave spending account (“ExtraCash”), but in exchange, you get intuitive app tools and ultimate flexibility to choose your own repayment dates if next payday doesn’t suit you.

Pros

- Automatic overdraft protection included

- Overdraft fee cheaper than most banks

- Flexibility

Cons

- $1 monthly subscription fee

- Set-up hurdles

- Additional fees apply

Chime – Best for No Fees

Maximum Loan: 200

Fees:

- No fees

- Tipping is optional

Speed: Instant using the “SpotMe” feature

APR: 104.3% APR if you overdraw by $50 with a $1 tip and repay within 7 days.

Repayment: On your direct deposit date.

About: App-based Chime offers cash advances to Chime account holders via an overdraft protection service known as “SpotMe”. You’ll need to make at least $200 in minimum monthly direct deposits to your account to qualify but will benefit from a fee-free advance service and other perks.

Pros

- Overdraft protection of up to $200

- User-friendly app

- Optional tip

Cons

- Direct deposits must be made

- Chime checking account is essential

- Features are limited

Brigit – Best for Managing Your Budget

Maximum Loan: $250

Fees: $10 per month for a paid plan

Speed: Same day if sent before 10 pm

APR: A $100 advance repaid within 7 days on a $10 Brigit membership would incur an APR of 500+.

Repayment: Automatically set according to your income schedule

About: Brigit is one of the few cash apps that lets users extend repayment dates within the app. It also offers some exceptional in-app budgeting tools – though you’ll need to upgrade to Brigit’s paid plan at a cost of $10 per month to get cash advances.

Pros

- Credit check not needed

- No tipping/interest fees

- Amazing budgeting tools

Cons

- No instant deposits

- $250 withdrawal cap

- Monthly fees

Empower – Best for Quick Cash

Maximum Loan: $250

Fees:

- $8 monthly subscription

- $1 – $8 for instant advances

- 20% tips

Speed: 24 hours

APR: A one-time $150 advance repaid within 7 days plus subscription and instant advance fees would have a 486.7% APR.

Repayment: Next payday.

About: Empower providers’ users with a free 24-hour advance window and some superb budget-tracking and automatic savings tools. That said, you’ll need to pay an $8 subscription fee to register, as well as tips at up to 20%.

Pros

- Quick free speed

- Great app tools

- Fast registration

Cons

- Subscription fees

- Tips

- Other charges

Cash Advance Apps Compared: At a Glance

Our favorite cash advance apps are: MoneyLion, Dave, Chime, Brigit, and Empower – but which payday loan apps are best for you will depend on your unique financial circumstances and how much you intend to borrow. Let’s review what’s on offer.

| Cash Advance / Personal Loan Amount | Cash Advance Speed (Free) | Cash Advance Speed (When Paying Fee) | Overdraft Fees and Other Charges | |

| MoneyLion | $25 – $250 | 24 – 48 hours | $0.50 – $9 | N/A |

| Dave | $500 max. | 24 – 72 hours | $2 – $14 | $1 membership fee (monthly) |

| Chime | $20 – $200 | Instant | N/A | N/A |

| Brigit | $50 – $250 | 24 – 48 hours | N/A | $10 membership fee (monthly) |

| Empower | $10 – $250 | 24 hours | $1 – $8 | $8 subscription fee (monthly) |

As the table demonstrates, different apps have different terms. While Dave is your best bet if you’re looking for a large cash advance of up to $500, Chime offers a fast, fee-free platform that’s good for existing users of their other services, and Empower is the top choice for quick cash.

Get Bank Account Cash Advance Apps Today

Apps enabling cash advances are becoming increasingly common, but with so many out there to choose from, it’s important to pick the right apps to suit you – and not to rule out alternatives like credit unions and loans, either. Keep in mind, that:

- Different cash advances apps have different functions, pay periods, and monthly fee terms, so you’ll need to read up on what kind of services your preferred app provides.

- You might need to pay a fee to claim your cash advance within 3 days or less, while overdraft fees and other charges may apply – particularly if you want your advance cash instantly or a later repayment date

- If your financial needs are urgent, licensed moneylenders like FortuneCredit can grant you a superfast personal or payday loan to cover your costs.

In case you need a payday loan, credit builder loan, or short-term cash, Fortune Credit offers affordable loan products with the same-day disbursal of cash and fair interest rates starting at 1%. Apply now and get your cash today!

Also Read: Cash Flow at Risk: Tools for Financial Planning

Strategies of Implementing DevOps for Success

The Top 5 Email Extractor Apps of 2024

How Can QR Codes Simplify Your Daily Routine:…

All-Inclusive Guide on RTasks Login at RTasks.Net!

SPYX Review: The Ultimate Spy Tool for Worried…

From Exams to Exercise: How Health and Wellness…

Spotify Receiptify: Learn How to Create & Share…

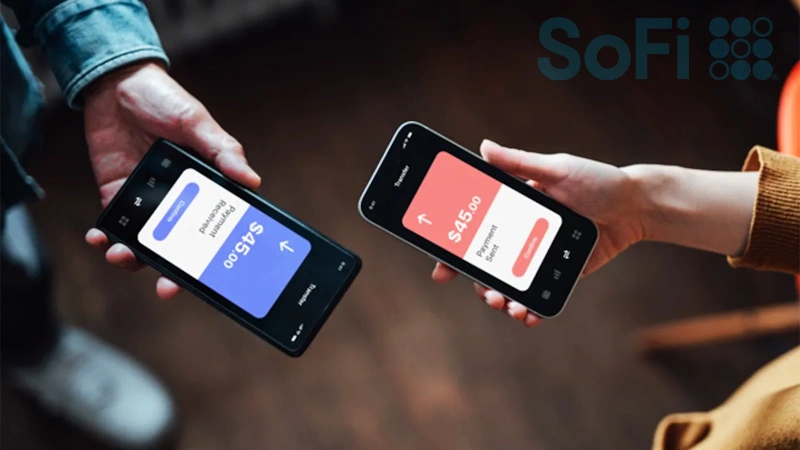

Unlocking the Power of Money Transfer: Simplifying the…

Secure and Swift: Exploring Online Money Transfer Options

What Is Spotify Color Palette, How to Create…

Maximizing ROI: Tips for Cost-Effective Direct Mail Campaigns