Unlocking the Power of Money Transfer: Simplifying the Process of Fund Transfer

Key Takeaways

- Online money transfer has revolutionized the field of finance.

- Digital wallets, online banking, and P2P platforms are some of the effective ways to transfer your money.

- Cryptocurrencies have also reshaped the landscape of online transactions.

- The power of money transfer lies in its versatility, opening up various opportunities for users around the world.

In the age of digitization, the ability to transfer funds online has emerged as a significant game-changer in the world of finance. Understanding the intricate webs of the money transfer process is like possessing a master key to global economy gates.

This article aims to demystify the process and empower you with information about five effective ways to transfer funds.

Online Banking: The Backbone of Digital Transactions

Online banking forms the backbone of digital transactions today. This reliable method is analogous to the workhorse of the financial world, consistently ensuring that your money gets to its intended destination.

It enables direct account-to-account transfers, offering a high level of security with the backing of robust bank protocols. You do not have to visit a branch for this transaction. You have the liberty to carry it out whenever you want, such as at home, at work., or while you travel.

However, it’s like playing a well-tuned piano – you must ensure you strike the right keys, which means you must enter accurate recipient’s bank details to avoid any disharmony.

All it requires is to register on the bank’s online banking service and then create a password. After this, you can avail their service.

Interesting fact

Although the use of online banking stood at 22.8% in 2019, it had seen a decline since 2015 due to the upsurge in the use of mobile banking.

Digital Wallets: Convenience in Your Pocket

Think of digital wallets as a sleek, compact car that takes you from point A to point B in record time. These user-friendly applications are all about convenience and speed.

You can send money globally with just a few taps on your smartphone. The key here is to keep your wallet safe and secured, much like you would protect a luxury car from theft, given the potential risks of cybercrime.

It usually uses software that connects your payment details from your bank account to the seller. Various digital wallets are there in the market such as Apple Pay, Google Pay, PayPal, and many more. You can select based on your location, needs, and also on the type of smartphone that you are using.

Digital wallets have transcended beyond just online money transfer services. Many of these platforms now offer a range of financial products and services, such as prepaid cards, virtual debit cards, and cashback rewards.

Some even provide investment options, allowing you to grow your money within the same application. Integrating various financial features makes digital wallets a one-stop solution for your financial needs.

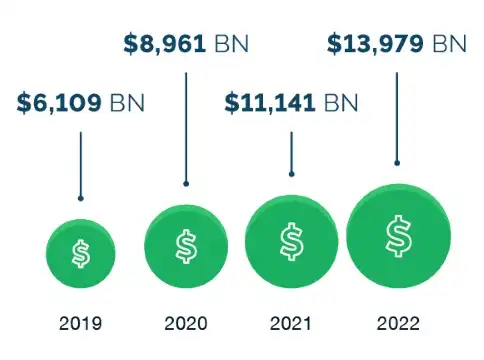

In 2022, around 89% of Americans were using digital payments. Besides, there has been a steady rise in the American people using two or more forms of digital platforms, from 51% in 2021 to 62% in 2022.

Peer-to-Peer (P2P) Platforms: The Social Network of Money Transfers

P2P platforms act as the social network of the financial world. These platforms enable you to transfer money directly from your account to another individual’s account while keeping your bank account details private. It’s as easy and informal as passing a note in class but more securely and digitally.

Features like bill splitting and money requesting make P2P platforms popular for transactions among friends and family. One only needs the recipients’ mail addresses or phone numbers to add them to your contact list within the app.

For instance, you went out on brunch with your friend and split your bill. Instead of going through the hustling process of paying in cash paid by two different people, you pay the bill with your card.

Your friend repays you by opening up the application, selecting your name from the contact list, and paying the amount he owes you.

SoFi experts explain, “You can transfer money to friends and family via a peer-to-peer (P2P) transfer. Log in to the SoFi app, select “Send money to a friend,” and input the recipient’s email address or phone number. They should receive the money in two to three business days.”

Do You Know?

In 2022, 84% of the users were using P2P services. Among its popularity, around 23% of its users sent money to the wrong person and 15% have fallen into scams.

Remittance Services: The Global Money Movers

Remittance services are heavy-duty trucks in the world of finance, designed to handle international transactions. These services specialize in global transfers, accommodating different currencies and countries.

They provide online and in-person facilities, allowing you to choose your preferred method. Just as one would compare the capacities and mileage of trucks, it’s pertinent to consider these services’ varying exchange rates and transfer fees.

Remittance services are generally used by foreign people to send money to their family members back home. There is often a fee charged for this procedure.

As per the World Bank’s Migration and Development Brief, in 2021,$605 billion in remittances were transferred to low and middle-income countries.

Cryptocurrencies: The Cutting-Edge of Money Transfers

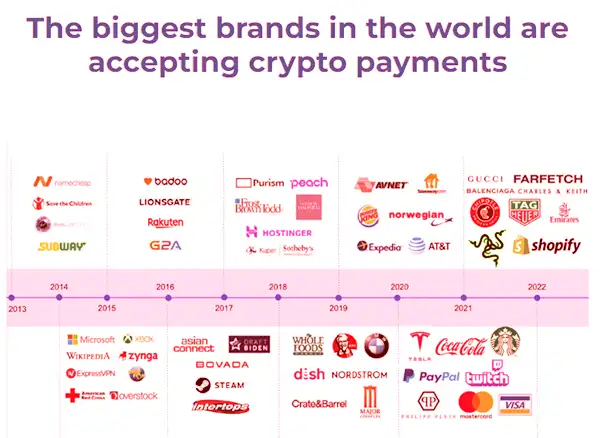

Finally, cryptocurrencies represent the hypercars of the financial world, offering futuristic, decentralized fund transfer methods. Bitcoin and similar digital currencies have reshaped the landscape of online transactions with their fast, low-cost transfer capabilities.

They have a uniquely ‘no-middleman’ approach, cutting out banks and other central authorities. However, just like driving a hypercar, maneuvering through the volatile cryptocurrency market requires caution and understanding the potential risks.

Conclusion

The power of money transfer lies in its versatility. No matter whether you choose traditional online banking, the convenience of digital wallets, the sociability of P2P platforms, the global outreach of remittance services, or the innovation of cryptocurrencies, you can easily navigate the financial seas.

The fund transfer process has never been more accessible, efficient, or exciting, opening up a world of possibilities for users everywhere.

Strategies of Implementing DevOps for Success

The Top 5 Email Extractor Apps of 2024

How Can QR Codes Simplify Your Daily Routine:…

All-Inclusive Guide on RTasks Login at RTasks.Net!

SPYX Review: The Ultimate Spy Tool for Worried…

From Exams to Exercise: How Health and Wellness…

Spotify Receiptify: Learn How to Create & Share…

Secure and Swift: Exploring Online Money Transfer Options

What Is Spotify Color Palette, How to Create…

Maximizing ROI: Tips for Cost-Effective Direct Mail Campaigns

7 Tips to Choose Email Database of UAE…