5 Best Apps That Loan Money in 2023

The times that you will need fast cash for an emergency may never end. However, 2021 is now ending, and it’s time to make plans for 2023. And that’s why you will eventually need the best apps that will loan you fast cash in 2023.

I know that life through the pandemic hasn’t been a walk in the park. That’s why I will show you where and how you can get fast cash in 2023. First, however, there are things that you should know before you get a loan. Bad credit loans are financial products designed for individuals with a poor credit score.

Also Read: Things to Know About Loan App Development

What to Consider Before Getting a Loan

If you do not want to get into unnecessary debts, it’s a good idea to think big first.

Can you afford to repay the loan?

This question should be the first I mind whenever you think of taking out a loan. I advise you to take a loan that won’t stress you while repaying it.

What do you want to do with the loan?

Sorry to say this, but I will say it anyway because it will help you at some point. No matter how you are struggling, never take out a loan to cater to luxury needs. Instead, take loans if you have a pressing emergency that cannot wait until you get cash.

How are the interest rates?

The interest rate is the percentage that the lender charges you to earn their profits and other costs that they incur. Some lenders will charge you more than the standard interest rate in your state. Therefore, I recommend first comparing different lenders to get the best rates.

How long is the loan term?

A loan term is how much time you take to repay your loan completely. Some lenders only give you short-term loans, while others can give you loans that you can pay back for several years.

Knowing the loan terms ensures that you plan your finances early enough. And proper budgeting can help you in achieving your financial goals faster.

The 5 Best Apps Loan Money in 2023

The Earnin App

Earnin is an app where you can fast cash with no interest rates. Instead, the app allows you to send them tips, but optional. With the Earnin app, you can borrow up to $100, but your limit can increase over time.

However, your income should be steady for the last three months to use this app. In addition, your checking account should also be active. When you apply for funds here, you will get the cash within a maximum of two working days.

The Dave App

The Dave is another excellent app that will help you get an online loan. The maximum you can get from this app is $100. In addition, the lender doesn’t charge you interest rates. However, there is a $1 monthly membership fee.

The good thing about the Dave app is that they don’t do credit checks to their borrowers. Instead, they rely on your employment to give you some funds.

Brigit App

Brigit is another app that can loan you money without credit checks. The maximum advance you can get from this app is $250.

If you want to qualify for a loan in Brigit, your checking account should have more than $0 and earn more than $400.

Brigit notifies you whenever your account balance becomes low. Therefore, the bank will not charge you overdraft fees.

MoneyLion

With the MoneyLion app, you can get a loan of up to $250. In addition, if you want to build your credit, you can get a credit builder loan from this lender. However, they will charge you an APR of 5.99%.

This app has a free membership plan and a premium plan of $29 per month. The app’s premium membership allows you to access all its features.

PayActiv App

This app allows you to access your funds as soon as you earn them. However, the maximum you can get is 50% of your earnings and does not exceed $500. In addition, the app will charge you a 0-5% fee every time you use it. PayActiv doesn’t run credit checks to the borrowers.

Viva Payday Loans

Viva Payday Loan is not a direct lender but a platform to meet with potential lenders who will give you cash. The lenders on Vivapayday loans don’t run credit checks, and they welcome any Fico score.

You can get a payday loan Australia at vivapaydayloans.com.au starting from $100 to $5000. In addition, the repayment terms start from three months to 24 months. Therefore, Vivaloans is suitable for getting a higher loan amount for an extended period.

The lenders on the platform charge a minimum APR of 5.99% and a maximum of 35.99%. The good thing I like about Viva loans is that the lenders give you a decision within two minutes.

My Take

It’s simple to get an online loan nowadays. However, that should not push you to make wrong financial decisions. Instead, it would help create a reasonable budget according to your income.

Strategies of Implementing DevOps for Success

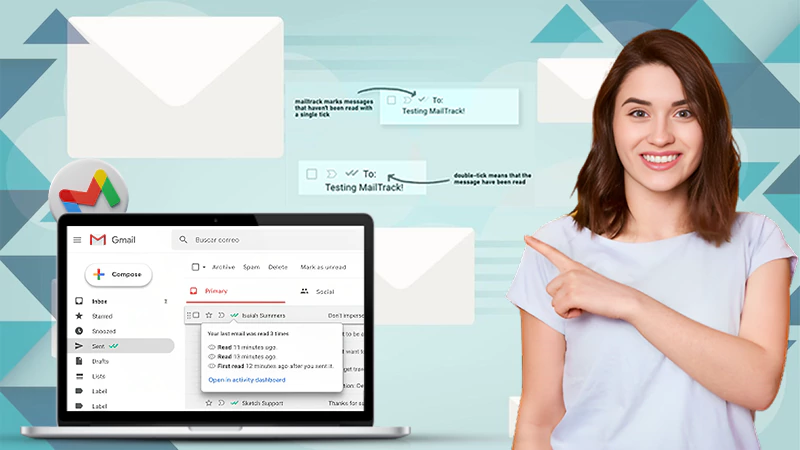

The Top 5 Email Extractor Apps of 2024

How Can QR Codes Simplify Your Daily Routine:…

All-Inclusive Guide on RTasks Login at RTasks.Net!

SPYX Review: The Ultimate Spy Tool for Worried…

From Exams to Exercise: How Health and Wellness…

Spotify Receiptify: Learn How to Create & Share…

Unlocking the Power of Money Transfer: Simplifying the…

Secure and Swift: Exploring Online Money Transfer Options

What Is Spotify Color Palette, How to Create…

Maximizing ROI: Tips for Cost-Effective Direct Mail Campaigns