Forex Brokers Unveiled: Finding the Ideal Partner

The world of forex trading is a dimension of boundless opportunity, where fortunes are made and dreams realized. As this realm continues its ever-evolving journey, it is pertinent to be kept abreast of this financial world.

Hence, finding the perfect forex broker is the key that unlocks the door to your success in this field. This article takes you on a journey behind the curtains, revealing the secrets and strategies to discover your ideal partner.

The Broker’s Role: Beyond the Basics

Before delving into the art of picking the ideal forex agent, let’s first understand the profound role they play in your trading journey. Forex brokers are varied but easy to choose from, depending on your goal and strategy.

Beyond providing access to the currency markets, your agent is your ally, your advisor, and your custodian of trust. They should facilitate your trades seamlessly, offer valuable insights, and ensure your funds’ safety.

Unveiling the Criteria: What Makes the Ideal Partner?

The search for the ideal Forex agent begins with a thorough analysis of a set of major criteria. We reveal these factors to assist you in understanding what is genuinely vital when looking for your ideal partner:

Trading Platform:

The platform provided by your broker serves as your cockpit. Investigate the features and tools that will help you make informed decisions. You can start by reading about the platform they are offering from the platform’s “About us” section. Besides that, reading all the “privacy and policy terms” can also help.

Security and Regulation:

Confidence in your partner is a requirement that must be fulfilled for effective trading. Learn how to find regulatory compliance and security procedures that will protect your money. You can read online reviews, or you can connect with the prior clients of the partner who might provide you with a satisfactory and honest opinion. If you are not confident with the regulations they put out for their customers, you can surely try exploring other options.

Asset Selection:

Your ideal partner should provide you with a varied variety of currency pairs and other assets to allow you to diversify your portfolio. You must be aware of the saying that the biggest risk is to rely on a single option. Here also, you cannot take the risk of holding on to a single option when speaking of an asset class. Try to diversify as much as you can and reduce the risk.

Trading Costs:

First-hand information about commissions, overnight fees, withdrawal fees, and spreads enables you to maximize profit. When the stakes are on your investments, you must make all things clear. All the hidden charges and fees should be disclosed at the first step so you can judge if the broker is good for you or not.

Customer Support:

In times of uncertainty, prompt, and competent support can be a lifesaver. Learn how to evaluate its client service. As mentioned earlier, when your money is involved in any dealing, you must ensure that the agent provides full support to your deals and throughout the relationship.

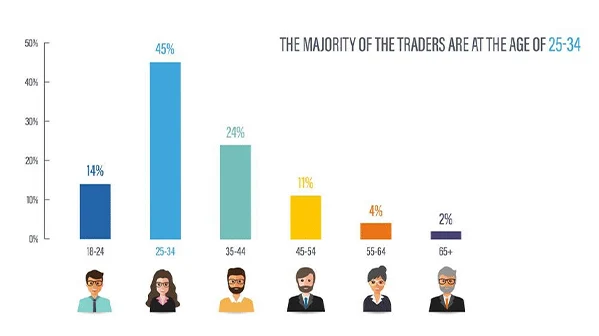

Interestingly, the graph pasted above shows the percentage of traders in different age groups. You can see that the youth between the age group of 25-34 are the most enthusiastic when the stakes are on investing their money in some assets.

However, there is no particular age group that is best for investing. Unless you are earning on your own, it is the right time for you.

The Art of Due Diligence

The intricate process of conducting due diligence on potential forex brokers is monumental to achieving successful results. From reading reviews and comparing spreads to assessing their technological prowess, you’ll gain insights into how to evaluate each broker’s suitability for your unique needs.

Creating Your Shortlist

Build a shortlist of potential brokers, isolate their pros and cons, and itemize your needs and requirements; this will enable you to have a streamlined pool to choose from. You can always consult a mentor or a foreign exchange trading expert to guide you to ensure your final choice is best suited for you.

Testing the Waters: Demo Accounts and Live Trials

Before committing your hard-earned capital, it is significant to understand what you want to do, and this involves trade trials. Make the most of demo accounts and live trials, allowing you to experience each broker’s offering firsthand.

Making the Final Decision

With your shortlist in hand and your trial experiences fresh in mind, the choice is yours to make. Learn how to balance factors like cost, convenience, and personal preferences to select the Forex broker that aligns perfectly with your trading objectives.

This is the final and probably the deciding factor in the whole process. Here you have to make the final decision on what alternative or which broker/agent you are finally going to go for.

Therefore, it is recommended that you choose wisely and make an informed decision.

Conclusion

Finding the ideal partner is not an aspiration in the world of foreign exchange trading; it is an attainable goal. This article provides you with the information and confidence to handle this major decision, ensuring that your forex journey is defined by success rather than just marked by it.

Take all these things into the criteria into consideration when speaking of making a decision for forex trading. Another significant point to consider is the currency pair. An underrated point, but it is still worth considering.

It’s time to reveal your career’s destiny and chart a road to financial success.

NBA Athletes Embracing Bitcoin: A Look at Their…

ArbiTrustCapital Review Helps Navigate the Trading World with…

Blockchain Brilliance: Unveiling the Future of Financial Freedom

Investing in the Digital Age: The Rise of…

Mastering the Art of Cryptocurrency Conversion with PHP:…

Here’s What to Consider While Opting For a…

What is Online Trading and How to Find…

Navigating the Digital Frontier: The Role of Crypto…

AI in Crypto Trading: The Future of Investing?

Immediate Momentum Review: Leveling Up the Crypto-Trading Game

The Only Bitcoin Trading Guide You Need!