Blockchain Brilliance: Unveiling the Future of Financial Freedom

The Central African Republic (CAR) is a landlocked country with a difficult economic landscape. In modern times the worldwide rise of cryptocurrencies especially Bitcoin has constituted difficulties for numerous nations in phrase of rule and obtaining.

This territory is no anomaly where an implied ban on Bitcoin has come out to affect the cryptocurrency prospect within its borders.

Understanding the CAR’s Economic Landscape

Before digging into the cryptocurrency circumstances it’s crucial to recognize the broader economic context of the Central African Republic. The country faces numerous challenges including political instability poverty and a reliance on traditional financial systems.

This county’s complicated economic structure makes it difficult for emerging fintechs such as Bitcoin to gain traction. The implicit ban further exacerbates these issues effectively sidelining the potential benefits that cryptocurrencies could bring in terms of economic inclusion and economic growth.

The country’s conservative approach to digital currencies reflects its overarching economic policies revealing a resistance to change and innovation. Go to the Quantum AI trading platform and make an account there.

The Rise of Bitcoin

Bitcoin as a distribution digital currency has obtained popularity worldwide for its possibility to give financial insertion and chances for those cut out from conventional banking systems.

Its decentralized activities often squabble with the regulatory formation of many countries, including the CAR. This place finds itself in a difficult situation with the rise of Bitcoin.

The country is grappling with how to balance the potential for financial inclusion that cryptocurrencies offer against the issues that arise from their unregulated decentralized nature.

The implicit ban on Bitcoin is a clear indication of the current stance but as the digital currency landscape evolves it will be interesting to see if this position shifts.

Interesting Facts

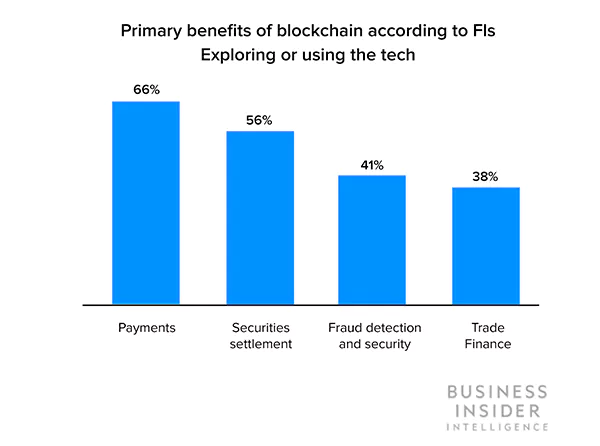

The above graph shows the involvement of blockchain technology in different operations of financial institutions. The highest use case of blockchain is in payment-related operations, with a 66% ratio.

Implicit Ban on Bitcoin

Unlike clear bans seen in a few countries, the Central African Republic’s stand on Bitcoin is more implied. The government has not officially held or managed cryptocurrencies leaving them in a gray side. This lack of regulatory clarity has led to challenges for those interested in trading or using Bitcoin within the country.

The unclear future of Bitcoin in this country raises serious concerns for the country’s financial evolution. As the world increasingly embraces digital currencies, the implicit ban could potentially stifle innovation and economic progress there.

It also underlines the country’s caution in navigating the murky waters of cryptocurrency regulation reflecting a larger global struggle to balance innovation and stability.

Challenges Faced by Crypto Enthusiasts

Individuals and businesses interested in cryptocurrency face several hurdles in the CAR. These challenges include limited access to exchanges uncertainty regarding legal implications and a lack of regulatory frameworks to protect users and investors.

As we progress towards a digital future, the attitude toward cryptocurrencies, especially Bitcoin, will significantly impact the financial landscape here. The challenges presented by the lack of regulation and the implicit ban on Bitcoin must be addressed to foster innovation and economic growth.

The balancing act between embracing new technology and maintaining financial stability continues to be a difficult route to traverse not just for this country but internationally.

Impact on Financial Inclusion

One of the possible upper hand of cryptocurrencies is their capability to get the monetary assistance to the unbanked and underbanked community. The implicit ban on Bitcoin in the CAR hampers the realization of these benefits, preventing the integration of marginalized communities into the broader economic ecosystem.

The current scenario in the country demonstrates the importance of a flexible and forward-thinking approach to financial regulation particularly in the context of emerging digital currencies. Cryptocurrencies like Bitcoin might potentially unlock novel economic opportunities for the country.

The journey towards integrating such innovative banking instruments will require careful navigation of regulatory challenges alongside a commitment to fostering transparency and protection.

DO YOU KNOW?

The infrastructure of blockchain technology is used by both businesses and consumers. There are around 81 million blockchain wallets in the world today. If you want to create one, you can take help from the online tutorials.

Government Perspectives and Concerns

The government’s careful proceed may stem from doubts about money laundering fraud and the potential to conflict with decentralized currencies on the stability of the national currency.

Balancing the potential benefits of cryptocurrency with the need for regulatory oversight remains a challenge for policymakers in the CAR.

As the Central African Republic charts its economic course the role of cryptocurrencies like Bitcoin is yet to be clearly defined. The implied prohibition underscores the country’s apprehensions about adopting this emerging financial destiny.

The government’s stance will inevitably shape the country’s financial future either paving the way for digital currencies or further entrenching traditional financial systems.

The country’s path into the realm of cryptocurrencies is a microcosm of the global effort to integrate digital currencies into established banking systems.

The Road Ahead

As the global discourse around cryptocurrencies evolves, this country faces the challenge of adapting to this changing financial landscape. Growing clear rules and instructions for the use of cryptocurrencies can foster innovation while addressing legal doubts about security and stability.

This country’s experience navigating the cryptocurrency realm serves as a case study for other nations grappling with similar issues.

As Bitcoin and other digital currencies continue to shape the world’s financial institutions the choices made by the CAR in the face of these emerging technologies will undoubtedly have far-reaching implications.

It remains to be seen how these decisions will influence the country’s economic trajectory and its position in the global financial system.

Conclusion

In navigating the implicit ban on Bitcoin the Central African Republic finds itself at a crossroads. Striking a balance between embracing the potential benefits of cryptocurrencies and addressing regulatory concerns is crucial for fostering a healthy and inclusive financial environment.

As the global conversation on digital currencies continues the CAR must carefully consider its position to ensure that it remains competitive in the evolving financial landscape while protecting the interests of its citizens.

NBA Athletes Embracing Bitcoin: A Look at Their…

ArbiTrustCapital Review Helps Navigate the Trading World with…

Investing in the Digital Age: The Rise of…

Mastering the Art of Cryptocurrency Conversion with PHP:…

Here’s What to Consider While Opting For a…

What is Online Trading and How to Find…

Navigating the Digital Frontier: The Role of Crypto…

AI in Crypto Trading: The Future of Investing?

Immediate Momentum Review: Leveling Up the Crypto-Trading Game

The Only Bitcoin Trading Guide You Need!

Top AI Cryptocurrencies for the Crypto Investors