Is There a Future for Bitcoin and Ripple in the Next 50 Years

Key Takeaways

Macroeconomic factors such as inflation and geopolitical uncertainty could increase the bitcoin demand.

There is no clear answer to the question, “Which cryptocurrency has a future?”. Blockchain technology has long been entrenched in all industries and will continue to play a necessary role in the financial world and everyday life

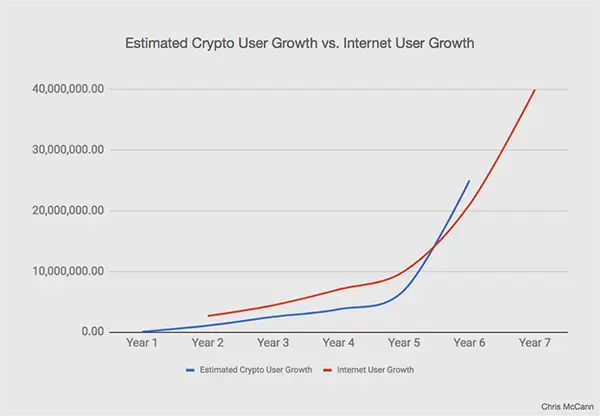

Cryptocurrencies have continued to take over the market for the past few decades. Digital currencies are not a stable unit. But that doesn’t make their popularity any less. On the contrary, investors are studying the market, KYC meaning, and investing in cryptocurrency. Investing in crypto is a complex and responsible process. You need to study a lot of information to analyze the rise and fall of cryptocurrency and become an expert.

We offer this article to familiarize you with the dynamics of popular cryptocurrencies, Bitcoin and Ripple. Do they have a future?

Do You Know: Cryptocurrency was discovered in 2009 under the name of an unknown person or group called “Satoshi Nakamoto”.

Bitcoin: Does Cryptocurrency Have a Future?

As of mid-2022, there are over 10,000 different cryptocurrencies. Among them are several non-public ones and some dead files for which there are no current transactions or price data. Extensive crypto exchanges usually have several hundred denominations traded.

The market capitalization of all cryptocurrencies, i.e., the number of shares outstanding multiplied by the current market value, was almost 900 billion euros in June 2022. In 2021, this market capitalization was almost 3 trillion euros due to the higher exchange rates of many currencies at that time.

The oldest, largest, and most valuable cryptocurrency is undoubtedly number one. However, from a technical point of view, the pioneering role of the Bitcoin protocol can be seen. Thanks to a proof-of-work mechanism to verify transactions on the blockchain, the currency has gained a reputation as a climate polluter in recent years – both mining and sending Bitcoins require large amounts of resources.

There are now many other cryptocurrencies that rely on an efficient mechanism. Ethereum, Solana, and other coins have overtaken Bitcoin’s adoption in real-world applications. You can check online information about the current ratio of cryptocurrencies to fiat money at the crypto converter. You can quickly calculate the amount of your investment.

If Bitcoin’s future will be as a cryptocurrency or will be replaced by other coins depends on the role that these blockchains will play in the future financial system. If decentralization occurs, Bitcoin will be the only major cryptocurrency that meets this requirement. However, integrating blockchain technology into the existing financial system is also possible – something Ethereum and the company are aiming for with smart contracts. Cryptocurrency such as Bitcoin has no future here due to its slow nature.

Amidst the current downturn in the cryptocurrency market, Bitcoin is the center of attention worldwide. With a current price of around $27,000 in mid-May 2023, which is about 2% per week, the question is if Bitcoin is ready for a new bull market or if we need to prepare for another bearish year.

First of all, the general acceptance of Bitcoin as a payment method could significantly impact the price. Second, increased institutional participation could boost the price. Third, regulatory clarity and support could have a positive impact. Fourth, the continued scarcity of bitcoin due to the halving of bitcoin could increase its price. There are various speculated advantages and disadvantages of cryptocurrency in 2023.

Finally, macroeconomic factors such as inflation and geopolitical uncertainty could increase the bitcoin demand.

However, it is vital to remember that these factors are unpredictable and constantly changing. Therefore, monitoring the market and making informed decisions is crucial.

Interesting Fact: Bitcoin has been described as an “economic bubble” by at least eight recipients of the Nobel Memorial Prize in Economic Sciences in 2018 itself.

Ripple Forecast: These Partners Influence the Rate

Partnerships are a pivotal topic in connection with Ripple. As something of an old hand in the crypto world, they have always attracted companies from the financial world. As a “blockchain for banks,” the crypto project has sparked interest in the banking world.

Today, there are more than 200 banks and financial service providers operating on the Ripple partnerships platform. Some companies use the Ripple network for payment transactions, while others use the crypto project’s technologies (apps and applications).

Brad Garlinghouse, CEO of Ripple, has previously confirmed that several hundred companies are already part of the platform. He believes prediction is a good solution, especially for large-scale projects like cross-border payment transactions.

Major confirmed partners include big names such as Mitsubishi UFJ Financial Group, Santander Bank, American Express, BBVA, Western Union, UBS, and Uni Credit.

Up-to-Date Forecast on Ripple

With the Ripple protocol, developers want to create a worldwide digital decentralized transfer system in which every transaction is fast and secure. Although it is considered a cryptocurrency, XRP is not based on blockchain technology. Ripple processes transactions through independent verification servers operated by banks, institutions, or individuals.

The underlying protocol is released under an open-source license, so banks can quickly adapt it for their purposes. However, at the moment, Ripple is still under pressure because of the U.S. The Securities and Exchange Commission wants to treat the Ripple coin as a security and apply the same regulatory conditions.

Several things inspire optimism among experts and analysts and suggest a good development of the Ripple price. Among other things, these arguments speak in favor of an increase in the price of XRP:

- Many large banks are using Ripple as it increases their competitiveness. Banks were soon left behind regarding transaction speed, fees, and security with blockchain. This platform currently has over 200 organizations as partners.

- Until recently, Visa has been on top of the game regarding transaction scalability. After the update, it can perform up to 50,000 money transfers per second. Right now, this platform is running much slower than planned.

- Ripple unveiled Codius to enable smart contracts. Spring is another Ripple initiative that allows companies to invest in startups. Hopes are also high for the release of the Cobalt algorithm. This was announced at the end of 2018, and it could significantly impact its price outlook and momentum.

Today cross-border transactions are an integral part of the business. It would help if you used a decentralized cryptocurrency revolution to make transactions fast and secure. This is one of the most efficient ways to earn money and exchange digital currencies with partners.

There is no clear answer to the question, “Which cryptocurrency has a future?”. Blockchain technology has long been entrenched in all industries and will continue to play a necessary role in the financial world and everyday life. Cryptocurrencies will still exist in 2030.

However, this does not necessarily mean that prices will continue to rise. So far, cryptocurrencies that can provide the fastest and cheapest transactions with a stable exchange rate have been used in the economy – the most valuable cryptocurrency is not one of them.

NBA Athletes Embracing Bitcoin: A Look at Their…

ArbiTrustCapital Review Helps Navigate the Trading World with…

Blockchain Brilliance: Unveiling the Future of Financial Freedom

Investing in the Digital Age: The Rise of…

Mastering the Art of Cryptocurrency Conversion with PHP:…

Here’s What to Consider While Opting For a…

What is Online Trading and How to Find…

Navigating the Digital Frontier: The Role of Crypto…

AI in Crypto Trading: The Future of Investing?

Immediate Momentum Review: Leveling Up the Crypto-Trading Game

The Only Bitcoin Trading Guide You Need!