Things to Consider When Choosing a Public Insurance Adjuster

When considering hiring a public adjuster in Glenview to help you with your insurance claims, there are several things to consider. See the most important factors below to put your mind at ease when hiring professional public insurance adjusters!

Also, Find Out: Are all life insurance policies similar?

What is a Public Adjuster?

Public Adjusters are a type of insurance adjuster that typically work for insurance companies. They are responsible for settling claims with policyholders, and they often have a great deal of experience with public insurance.

1. Public Adjusters Are More Experienced Than Private Adjusters

Public adjusters are more experienced than private adjusters. This means that they will have a better understanding of the ins and outs of public insurance. They will also be more familiar with the procedures involved in resolving claims.

2. Public Adjusters Are Familiar With Claims Procedures

Since public adjusters are familiar with claims procedures, they can resolve your claim faster and more accurately than a private adjuster would. This will usually save you money in the long run.

3. Public Adjusters Are Experienced With Handling All Types Of Insurance Claims

Public adjusters are familiar with handling all types of insurance claims. This means that they will be able to take care of your claim quickly and easily.

Why Choose a Public Adjuster?

When you are in a situation where you have been injured in an accident, the first thing that you may want to do is find a public insurance adjuster. There are many reasons why choosing a public adjuster is a good idea.

One reason is that public insurance adjusters are usually licensed and insured. This means that they are qualified to handle your case and will do everything possible to get you the compensation that you deserve. They will also work with you throughout the entire process, from initial contact to final settlement.

Another reason to choose a public insurance adjuster is their experience. Public insurance adjusters have typically been working in the industry for many years, and they know exactly what to do when it comes to handling cases like these. This means that you will have minimal disruption in your life while your case is being processed.

Finally, choosing a public insurance adjuster is often the best option financially. Because they are licensed and regulated, public insurance adjusters tend to charge a lower fee than private insurance adjusters. This means that you will be able to receive more compensation for your injury without having to spend too much money on fees upfront.

Seven Things to Consider When Choosing Public Adjuster

When choosing a public insurance adjuster, it is important to consider seven key factors. These are:

1. Experience and qualifications. Public insurance adjusters must have extensive experience and qualifications in order to properly assess and manage claims. They should also have law, accounting, and insurance degrees, among other areas.

2. Ability to communicate with clients. Public insurance adjusters must be able to communicate effectively with clients and obtain detailed information about their claims. They should be able to build a rapport with clients so that they feel comfortable discussing their cases with the adjuster.

3. Knowledge of public insurance policies. Public insurance policies can be complex, and an adjuster must have knowledge of them in order to identify potential issues with a claim.

4. Knowledge of the law. An adjuster must know the laws governing public insurance policies in order to make accurate determinations about a claim.

5. Proven track record of success. An adjuster’s success rate can be an important factor in choosing him or her as a public insurance adjuster. If he or she has a high success rate, this may indicate that he or she is well-equipped to handle your particular case.

Typical Traits of Public Insurance Adjusters

When you are trying to find a public insurance adjuster, it is important to look for someone with the typical traits of a good adjuster. Here are some things to keep in mind.

First and foremost, a good public insurance adjuster should be experienced in dealing with claims related to insurance. They should know how to investigate claims and how to handle negotiations with insurance companies. They should also have knowledge of state law and the insurance industry.

Another important trait of a good public insurance adjuster is empathy. They should be able to put themselves in the shoes of the client and understand their needs. This helps them to better deal with the client and negotiate settlements on their behalf.

Finally, a good public insurance adjuster should be very organized and adept at managing multiple tasks simultaneously. They should be able to keep track of multiple documents and deadlines, and they should be able to communicate effectively with clients and insurance companies.

The Challenges and Benefits of Removing Negative Online…

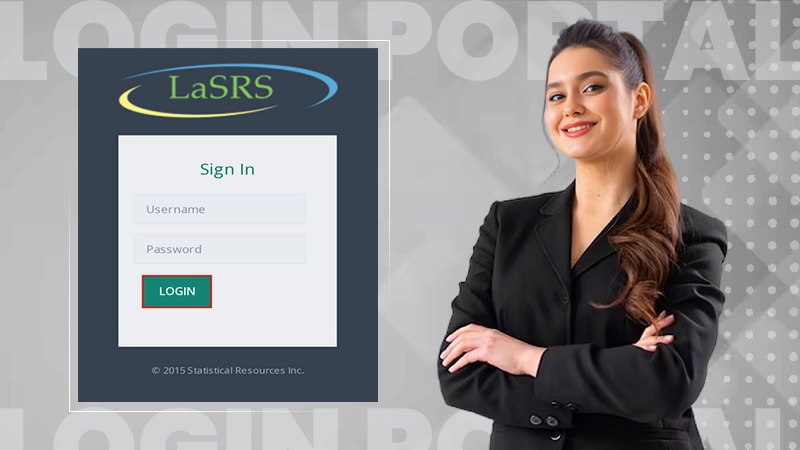

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support