Are all life insurance policies similar? Find out!

There are several alternatives available in the insurance industry for purchasing life insurance. There are several types of life insurance policies available and various types of life insurance companies.

When looking for a life insurance company, the best place to start is to understand that there are essentially two types of life insurance policies: term life insurance and whole life insurance.

lets understand the affordable life insurance plans.

Term life insurance is only valid for a set period (the “term”) and terminates after the policy. On the other hand, whole life insurance is a type of long-term care insurance. More insurance plans fall into these two categories, each with its own set of advantages and disadvantages.

Types of Life Insurance Policies

Here are the many types of life insurance policies, together with their characteristics and advantages, so that you can choose the best one for you:

1. Term Insurance Plans

Term insurance safeguards your family’s financial future if you die. A term plan is an essential aspect of financial planning for the principal income earner in a family since it is designed to be a straightforward and reasonable solution to provide financial insurance.

Term insurance is a pure protection plan not connected to the market. Furthermore, term insurance rates are lower than any other life insurance product. Premiums are also less expensive if purchased early in life. Experts frequently advise that you prioritize a long-term strategy as soon as you begin earning money.

Term insurance can be utilized for a variety of reasons. Without an income, your family can use the insurance coverage to pay for day-to-day expenses, education fees, or wedding expenses. If you have any outstanding obligations, such as a house loan or auto loan, your family can use the insurance to pay them off.

2. ULIPs – Unit Linked Insurance Plans

A unit-linked insurance plan (ULIP) is a type of life insurance policy that also serves as an investment vehicle. A ULIP provides life insurance that protects your loved ones financially. Furthermore, a life insurance company offers you the opportunity to build wealth through market-linked returns through systematic investments.

A ULIP allows you to invest your money in various fund alternatives based on your risk tolerance. ULIPs have a 5-year lock-in term and can be invested in bonds, stocks, hybrid funds, and so on. Bonds might be an excellent alternative if you want to invest in something that is more secure. On the other hand, if you are willing to take on greater risk, hybrid funds and equities may provide superior returns.

3. Endowment Insurance Plans

Endowment plans are appropriate for consumers who desire the security of life insurance as well as guaranteed profits. An endowment plan is a type of life insurance policy that combines life insurance with the ability to save money regularly. This allows you to get a lump sum payment when the insurance matures. If you die within the insurance term, your nominee(s) will also get a death benefit.

Endowment plans, like ULIPs, are incredibly adaptable. You can select an appropriate method and time range to pay the premium. Endowment plans also provide you with the opportunity to get bonuses that are paid in addition to the sum assured of your policy.

Finally, the profits generated by an endowment plan at maturity are tax-free* under Section 10(10D) of the Income Tax Act of 1961. The premiums paid may also be deducted under Section 80C* of the same Act.

4. Money Back Insurance Plans

A money-back plan is a type of life insurance policy in which the insured receives a portion of the sum promised at regular periods from the life insurance company. Because you save regularly, the money-back plan pays you regularly.

A money-back plan is essentially an endowment plan with the added benefit of enhanced liquidity and predictable distributions. Money-back programs are intended to assist you in meeting your short-term financial objectives. The money-back function might increase your monthly or annual earnings.

The frequent payouts, which are tax-free under Section 10(10D)* of the Income Tax Act of 1961, make the investment process extremely profitable. This is because you can profit from the coverage right now.

Many life insurance companies provide Money-back plans that offer a maturity benefit as well. As a result, at maturity, you will get a lump sum payment that may be utilized to protect your future or help you achieve your family’s ambitions.

5. Whole Life Insurance Plans

A whole life insurance policy is a type of life insurance policy that provides coverage for 99 years. In contrast to other policies that have a comparatively shorter term of 10-30 years, the long coverage duration of such plans offers security for your family for a long period.

Whole life insurance is appropriate for individuals who have financial dependents even in their old age since it provides coverage for up to 99 years. The most significant benefit of this product is that it gives lifetime security to the insured and provides a straightforward option for them to leave a legacy for their offspring.

Whole insurance policies provide a great deal of security. After paying premiums for 5 years, you will get a guaranteed income at maturity. Furthermore, income from a whole life insurance policy is tax-free* under Section 10(10D) of the Income Tax Act of 1961.

6. Child Insurance Plans

Children deserve the best, and a child insurance policy can help you save for your kid’s future. A child’s plan is one of the most important financial planning tools available to parents. These programs might assist you in saving for your child’s schooling and marriage expenditures.

A child plan gives maturity benefits in the form of annual payments or as a one-time payoff when the child reaches the age of 18. There is also insurance coverage built-in for the parent. Because the parent pays the premium, protection is a crucial component of a kid’s plan. In the sad event that the insured parent dies during the policy term, the life insurance company can provide quick money to meet a child’s expenditures.

Read This Also: How Technology is Driving Innovation in the Insurance Industry?

7. Wrapping It Up

Term life insurance plans are often the best option for most people who want life insurance. They’re generally the most economical, easy to comprehend, and give the plain protection needed by most consumers looking for coverage at an insurance company. However, this does not imply that other types of life insurance policies are inappropriate for everyone.

Finally, to establish which insurance is best for you, you should consult with a qualified life insurance company, agent, or financial advisor. Knowing the pros and cons of your selections will make you a more informed consumer, allowing you to better grasp the alternatives offered to you – and make the best decision for your family.

The Challenges and Benefits of Removing Negative Online…

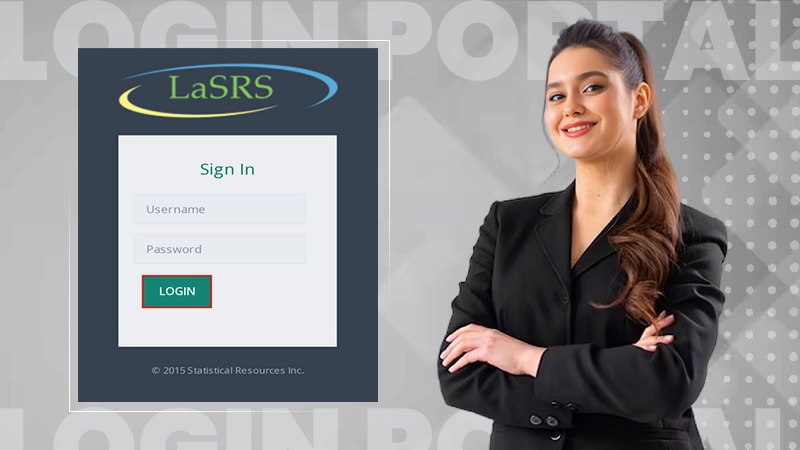

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support