Different Types of Payroll System

The prosperity of your company depends on picking the right payroll system because your employees are one of its most vital components. Your company’s compliance with legal requirements, your employees’ fair compensation for their work, and the effectiveness of your internal financial procedures are all ensured by your payroll system.

You, as an entrepreneur, must consider several things when operating a firm. It takes a lot to keep your business running well, from monitoring business processes to maintaining a happy workforce. How effectively you handle your employees’ payroll is one aspect that greatly impacts their pleasure. Each firm needs a comprehensive 401k paycheck calculator and system for a well-managed payroll and a basic record of the salaries paid to its staff.

Why is Payroll System Important?

- A payroll system organizes and processes your business’s payroll on a weekly or monthly basis to ensure your employees are paid correctly, and your legal requirements are met.

- A payroll system can be an internal procedure carried out by workers of your business or an external solution carried out on your business’s behalf by an outside entity.

- The hours workers work, leave claims, payroll taxes, and other deductions can all be tracked using a payroll system. Calculating and paying payroll taxes is a significant component of a payroll system.

Payroll Systems That are Internally Managed:

A company with fewer employees may find it practical to use an internally managed payroll system. With less personnel, it is simpler to monitor payroll records without significant errors. You can employ a resource expressly for this reason or manage your payroll independently. Knowledge of keeping payroll records and awareness of the many laws and taxes that may apply are the minimum requirements.

The following are the several features of an internally managed payroll system:

- Completed internally by a staff member.

- Utilizes integrated or standalone payroll software to calculate payroll.

- Payroll processing with a minimal number of inconsistencies and complexity.

Payroll Systems That are Expertly Managed:

The bookkeepers and Certified Public Accountants (CPA) come into play when we discuss professionally handled payroll systems. You can outsource managing your company’s payroll to a bookkeeper at an Edmonton accounting business or CPA if you lack the specialized skill. Another option is to contract with an expert from a reputable accounting firm. But remember that they can only assist you with managing your payroll records; they might not finish making transactions, bank deposits, and deductions.

A bookkeeper/CPA-managed payroll system has several features, such as:

- Completed by a payroll-focused outside bookkeeper or CPA.

- The bookkeeper/CPA oversees the automated payroll software system used to perform payroll.

- Gives the workers of the organization more capacity and capability.

Payroll System Agencies that Manage Payroll Services:

Hiring a payroll services company is another option to keep your payroll system accurate. These organizations handle your company’s payroll duties, including monthly salary deposits and deductions. These payroll service providers frequently guarantee accuracy and work to prevent late payments.

An agency-controlled payroll system has several features, such as:

- Payroll professionals with a high level of knowledge will be brought in by agencies managing payroll for your business.

- An organization will handle every aspect of processing your paycheck, including administrative tasks, deductions, and bank deposits.

Computerized Payroll Systems:

Software-managed payroll solutions are still uncommon but are slowly gaining acceptance. You may now handle your payroll using various tools and internet portals, saving yourself the time-consuming task of doing any calculations.

All you have to do is enter the information, and these digital platforms will keep track of it. You have a variety of options when it comes to managing your payroll effectively. You can manage payroll on your own or with software if you have a basic understanding of payroll management.

A software-managed payroll system has several features, such as:

- Cloud-based and accessible at any time, from any place.

- Depending on the employee information entered into the system from time records and other systems automatically calculates payroll information.

It’s important to be very careful when making your pick. Choose a reliable system, such as Paylocity alternative, to ensure your company’s payroll is managed properly. You can rely on Netchex in this regard. It’s easy to use, cloud-based, and pocket-friendly.

The Challenges and Benefits of Removing Negative Online…

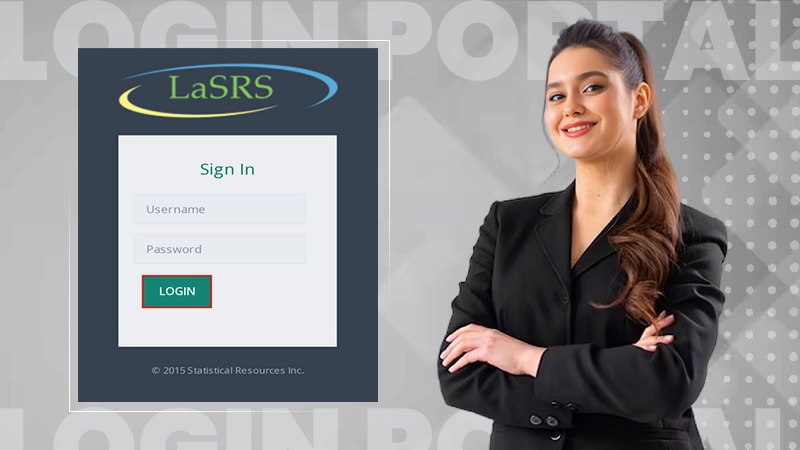

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support