Ten Tips for Getting the Best Student Insurance

Student travel insurance is a must-have when traveling to a new place to start a new course and work on your dreams. Student insurance guarantees that the insurer will take care of any damage caused to personal belongings and the costs associated with physical injuries.

To make the most out of your student insurance and land the most-suited insurance partner, you should follow these tips:

Analyse the Destination

Have a decent understanding of the whereabouts of the place you’ll be living. Enquire if the weather conditions are similar or different from your home country. Find out the possible diseases you might fall prey to. Understand the country’s medical infrastructure, whether it is public or private. Your insurance should cover your medical expenses along with the cost of medicines. You certainly would never want to face a financial crunch in a foreign country because of your health.

The Insurance Should Cover Flight Cancellation

Flight cancellations may be rare, but you never know when you are running straight into trouble. Getting stranded in a foreign nation or, worse, getting stranded in a nation from where you were supposed to catch a connecting flight is the worst nightmare. Thus check your student insurance for flight cancellation coverage.

Baggage Insurance is a Must

Not just clothing and personal essentials, but students carry their expensive laptops, smartphones, and smartwatches and not forget their prized possession i.e.the study material. Now you have two options: buy individual insurance for each item, like MacBook insurance or watch insurance. Or you can get your entire baggage insured at once. The last thing you want to discover in a foreign country is that your baggage is lost at the airport. Even though the majority of the insurers cover baggage, you are advised to check for the same.

Choose a Flexible Insurance Policy

Traditional insurance coverage generally extends to the financial or the calendar year. However, if you have the start and end dates of your scholarship program and have already booked your flight tickets, buy student insurance only for the duration of your stay. Avoid paying for annual insurance that covers periods beyond your stay in the foreign state.

Your Insurance Should Have an Extension Clause

You cannot always expect events to fare your way. There could be multiple reasons why you might have to extend your stay abroad. Now buying new insurance for an extended period of stay would be a costly alternative. Instead, you can apply for an extension of your existing student insurance, provided your insurance policy has an extension clause.

The Insurance Should Meet the University Guidelines

Several foreign universities have made it mandatory for international students to have student insurance. Moreover, failing to follow guidelines for insurance issued by universities may jeopardize your waiver benefits. Universities even reserve the right to cancel your admission, or else they may ask you to get insured as per their guidelines. For instance, universities in the USA and Canada have made it mandatory for students to have pre-existing illness coverage. Thus, ensure your student insurance covers all the pointers your universities give.

Medical Insurance Coverage

Medical treatment abroad can be really expensive. A regular doctor consultation in the USA costs several hundred bucks. Within no time, medical bills will add up to a considerable charge to your pocket. Make sure your student travel insurance covers your medical bills adequately. Check your insurance plan for the maximum sum insured for medical coverage. Get student insurance with generous medical coverage, even if it adds slightly to the premium. Do not compromise on that.

Breaks or Interruptions in Studies

Personal or professional commitments may force students to return to India, leaving their studies. Nobody can prepare for such unforeseen events in advance. Thus buy student insurance that covers the expenses of your sudden return.

Facility for Online Consultation from the Doctor

Being a student, you’d always want to save every penny you can. Visiting a doctor’s clinic for routine checkups is both time-consuming and costly. Good student insurance will cover a ‘tele-assistance’ service that will help you connect to your doctor from the comfort of your home.

Sports Enthusiasts should Look for Sports Coverage

Every country has its sporting attraction and if you are daring enough to try those alongside your academics, ensure you are insured for the adventurous sports. Not many of you would know if any such cover like this exists, but it does. Enjoying adventure sports in a foreign country becomes even more fun when you know the insurance company has your back.

While these tips can be helpful when selecting the best student insurance, one must always enquire about every detail that concerns you personally.

The Challenges and Benefits of Removing Negative Online…

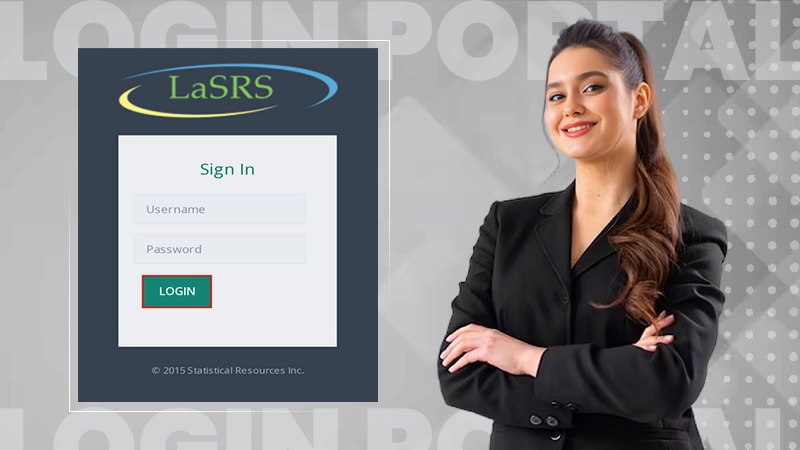

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support