6 Tips to Deliver the Best Service as a Health Insurance Agent

If you have ever thought about working as an insurance provider or questioned whether this is the correct career route, there are a few traits you will need to have. With relatively large commissions, a high level of autonomy, and flexi-time, becoming an insurance agent may be a successful endeavor.

But it is not a simple job. High levels of consumer refusal, dissatisfaction, and retention are to be expected. However, all competent insurance providers share the following fundamental attributes and talents. This article will cover how you become a health insurance agent and the services you need to provide to your customers.

Health Insurance Agent

Going to invest in the client experience is one of the cornerstones of the insurance industry’s continued success. Giving your customers a thorough, individualized experience will increase their familiarity with their insurance policy, lower the frequency of claims, and increase the likelihood that they will continue to use your company even if their coverage needs to change.

But what do customers today expect from their insurance providers? Here are a few methods for reaching and serving clients more effectively to become a good health insurance agent.

6 Tips on How to Become a Good Health Insurance Agent

Prioritizes the Demands of the Customer

Without regard for the requirements of the customer, an agent who is just interested in earning a commission is unlikely to succeed in the industry for very long. The difficult part of an agent’s job is gaining the credibility of their clients or potential clients. Therefore, listening intently to what they have to say can help them succeed.

Excellent Client Service

Clients are far more likely to remain satisfied and at ease, if they can contact their representatives whenever they need to. You must be able to carry out your commitments when you say you will, or at the very least have a credible excuse for why you can’t, and you must respond to questions and phone calls promptly.

Having Emotional Maturity

This includes the capacity to hear customers out and connect with them deeply to ascertain their true needs and desires. Even when a customer is adamantly opposed to it, a skilled agent is diplomatic and knows how to assist the client in properly understanding financial reality.

The High Degree of Energy

Being enthusiastic and motivated at all times are among the qualities that make an excellent insurance agent stand out.

Dedication

This is possibly the most important trait of a competent insurance provider. People who operate in this industry must be able to accept rejection with a smile regularly throughout their careers.

Technical Expertise

A competent insurance provider is capable of much more than just selling a policy. The sales representative must be familiar with the tax and legal implications of the goods they sell as well as how they are crafted to work with a customer’s financial health.

Why Opt for a Medical Insurance Plan?

The advantages of health insurance are now more important than ever. The number of people having health problems because of their lifestyles is rising. While it is important to take additional steps to maintain good health, prioritizing your financial security should also be your top priority.

To put health insurance in perspective, consider a handful of these major benefits.

Protect Your Loved Ones

The advantages of health insurance might be very useful if you are a wage earner with financial dependents. Medical situations may not always be fully avoidable, but you may always be prepared for them.

Safeguard Your Savings

Every diligent individual takes the required steps to maximize their savings over time. However, the rate of medical inflation could make them inadequate when most required. The advantages of health insurance will lighten the load on your finances and free them up for other significant life needs.

Also Read:- Guide to take control of your finances

Clarity of Mind

In life, your mental stability is precious. The majority of life’s challenges seem doable when you are safe. The advantages of having health insurance are most beneficial in allowing you to live peacefully.

Wrapping Up

These characteristics are just a few of one’s life as an insurance provider who wishes to succeed. The life insurance sector may be both incredibly challenging and extremely profitable for people who are prepared to acquire the skills necessary to expand their firm.

Next, can read: How Healthcare Industry Leverages Machine Learning Through Wearables

The Challenges and Benefits of Removing Negative Online…

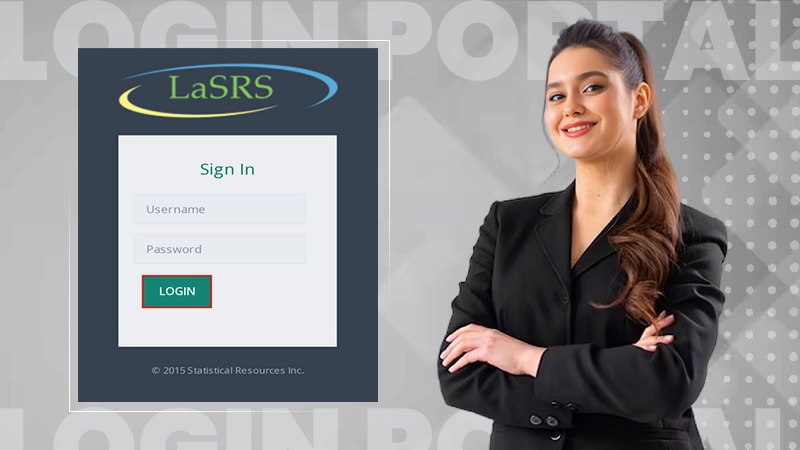

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support