5 Quick Steps to Start Your Digital Banking Journey

In the chaos of modern-day lifestyles, evolving technology provides convenience and efficiency to day-to-day tasks. With the progression of automation in our routines, digital banking is another pivotal aspect, offering us the comfort of managing our finances without having to leave our homes.

No matter if you’re a student, a professional, or a homemaker, learning how to set up a bank account online is basic to enjoy the freedom of financial flexibility and smooth monetary management. So, dive into the article and embark on your banking journey in five simple steps.

Selecting the Right Bank: A Foundation of Trust

Opting for an appropriate financial institution is the stage in your online banking expedition. While making the choice, consider other factors such as interest rates, fees, and offerings as well. Don’t merely go for the financial aspects, but also focus on reviews and feedback and compare with other banks carefully.

The comparative examination will make sure the bank you will build your relationship with, fits best for your monetary objectives and values, laying a healthy and strong foundation for a long-lasting agreement.

Navigating the Prerequisites: Preparation is Key

Once you’re done with the selection process, learning about the conditions and essentials for an account opening is the second stage. This process usually involves the submission of your identification documents, proof of address, or a minimum deposit (in some cases).

To eliminate the risks of delays or rejections and accelerate the speed of the account-making procedure, make sure you have detailed know-how of these requirements. This step assures a seamless initiation process, eradicating unwanted obstacles, and speeding up a quick transition to the next stage.

Online Application: A Step into the Future

SoFi states, “Opening an account is quick and easy. All we need are a few pieces of information such as name, home address, and Social Security number.” That is exactly what the third stage is about; the application process. It is also an actual step into digital finance.

Today, most banks provide customers with user-friendly interfaces informing them through every action of the application. The procedure involves filling out a form with the required personal and financial details and uploading the necessary documents.

Though the step is not difficult, it should be taken carefully and done accurately. Even a single error can cause complications or potential delays in the account activation. Once submitted, a verification process will start to ensure the reliability of the submitted information.

Activating Your Account: Embracing Financial Autonomy

After the success of the application filling and verification process, you will receive the green signal to activate your bank account. Now you’ll have to create a username, and a password (make sure the password you create is strong and unique, having uppercase and lowercase letters, numbers, and symbols).

Most sites, today, also give options to set security questions, keys, or two-factor authentication to make your account more secure. A well-protected account will not only give you peace of mind but will allow you to make safe transactions, monitor your actions, and manage your assets without worrying.

Exploring Features and Services: Unleashing Potential

Once you’re done with the account-making process, don’t forget to explore the countless features and services provided by the platform. Digital banking, today, is not limited to depositing and withdrawing money but it also provides features like transferring funds, paying bills, investment opportunities, and more.

Delve into the assistance provided and make sure you take advantage of your online bank account. With all the regular monetary services, it will help you in optimizing your financial management, and growth, and enhance your banking experience.

Do You Know?

As per a study, there will be 216.8 million digital banking users by 2025 in the US.

Benefits of Having a Digital Bank Account

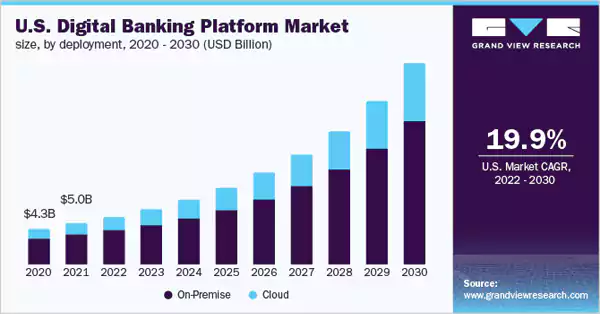

(This graph shows the U.S. digital banking platform market size, expected to expand at a CAGR of 20.5% from 2022 to 2030).

The perks of opting for an online banking platform are countless. In this section, we’ll explore some of them.

- Bank on Your Phone – Making transactions or other adjustments to your bank account couldn’t be easier. There’s no need to leave your comfortable couch and rush to the bank whenever you need to do any business. With online banking, you just need a smart device and a good internet connection, and you’re done.

- 24×7 Support – One of the most appealing aspects of convincing people to have digital banking, is the 24×7 customer support. With digital banking, if you’re having any issues or a query, you don’t need to wait for the banks to open anymore. Most online banks provide 24×7 consumer services to their account holders.

- Transfer Money or Make Payments from Anywhere – Now, you can shop anything online from the comfort of your home or even transfer money in a few clicks or taps. Digital banking gives you the freedom to do business anytime, anywhere.

- Secured Transactions – With the progression of cybersecurity, it is beyond the bounds of possibility to commit any online fraud. Digital banking systems are well-secured enough to protect your online assets or financial data.

Conclusion

Initiating a digital banking journey may feel overwhelming, but the amenities and resilience it offers are unparalleled. It is indeed a futuristic approach to maintaining your monetary decisions while saving time, and opening up new financial possibilities.

There’s a phrase that says, “The world has become a global village”. This means the world is rapidly adopting digital trends and online banking is a part of it. Holding a digital bank account will ensure a more efficient and seamless financial future.

Blooket Login: Ultimate Guide to Login and Gameplay

10 Fastest Growing Tech Jobs in 2024

Justice: How Technology Transforms Asbestos Lawsuits

Online Interior Design Courses: A Sustainable Choice for…

Private Tutor vs Teacher: What’s the Difference?

Challenges and Opportunities in Implementing 5G Technology in…

Top 10 Common Essay Writing Mistakes and How…

E-Learning Trends to Watch in the Coming Years

Incorporating Research into Your Essays: A Guide to…

The College Student’s Guide to Coping with Stressors

4 Mistakes to Avoid When Starting a Private…