The Benefits of Using Bank Account Verification for Your Business

Since the implementation of new NACHA requirements in 2019 that demand businesses who take automatic bank withdrawal payments must introduce new layers of security for payment processing, businesses have been vying to find a suitable solution that works for both their customers and their company. This can be difficult, as sometimes it’s tricky to even notice the benefits that a paid solution can provide. However, businesses that do take the leap and invest in this area appreciate some fantastic benefits.

Also, Read About PaydayChampion: Apply Loans Online, Get Money into Your Bank Account in 1 Hour

Simplify the Process

Easily one of the best benefits of using bank account verification is the simplification of the payment processes that businesses use. With an ACH solution, it’s easy to maintain easy regular payments, as once a user’s bank account has been verified through an automatic system, recurring payments can proceed as normal, and this avoids the user having to constantly verify any small payments that hit their bank.

Meet NACHA Requirements

While the NACHA rules can seem overwhelming at times, businesses need to adhere to them, as the consequences for those who don’t do this can be exceptionally severe – some businesses face fines of up to $500,000 every month for violating the rules! To avoid the financial and reputational damage that could hit your business, it’s important to invest in a quality, up-to-date ACH payment verification system that will allow you to work confidently within the regulations.

Save Time and Money

By implementing a paid solution like Yodlee for processing ACH payments and verifying accounts, you can guarantee that your business will be saving time and money as well as offer your customers a seamless payment experience. Yodlee offers a range of solutions including account verification, open banking, and Fast Link, which allow your customers to use your products with ease while keeping your business’ security and professionalism at the forefront.

Reduce Fraud

Lastly, one of the most popular reasons for businesses investing in an account verification service is the effectiveness with which they reduce fraud and protect the integrity of their systems. It is estimated that U.S businesses lose up to 5% of their yearly gross revenue to fraud, but by using bank account verification, your systems can catch fraudsters before they have the opportunity to even open an account with you, and this will block any unauthorized access to the business’ system. Not only does this allow you to focus on the things that drive your business growth, but it also gives your customers the confidence to navigate your site and services without worrying about the security of their personal and payment information.

While it might be tempting to use cheap, basic payment systems for your business, investing in a bank account verification system that manages your security and reduces fraud automatically is one of the best moves that your business can make. Along with saving you time and money, this will allow you to consistently stay within NACHA requirements and reduce the risk of your company picking up a large fine for rule violations. By choosing the right provider, you can impress your customers while simplifying the payment process for your employees, so it really is a win-win for everyone!

The Challenges and Benefits of Removing Negative Online…

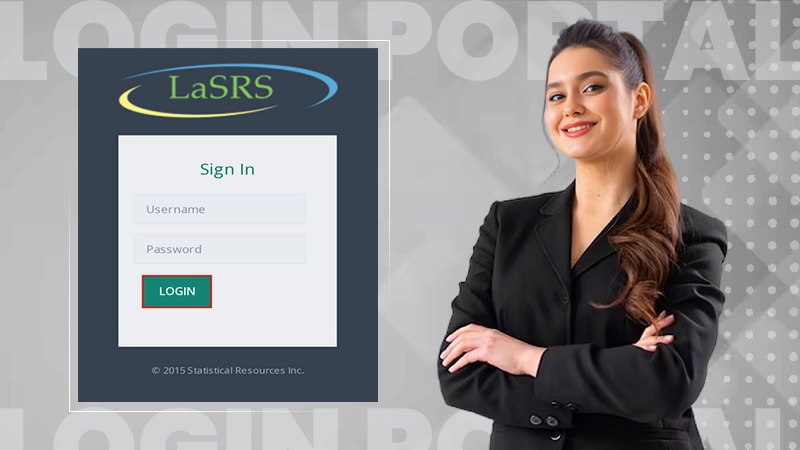

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support