Why is Workers’ Compensation Important for All Businesses? Here’s What You Need to Know

Workers’ compensation insurance is an integral part of doing business. Regardless of the size of your company, if you have employees, you need to have workers’ compensation coverage. Several states require businesses with one or more employees to have workers’ compensation insurance.

This blog post will discuss some of the basics of workers’ compensation insurance and why it is crucial for businesses. In addition, it will provide a few tips on how to choose the right coverage for your company, like https://cerity.com/solutions/workers-comp/ or any other insurance company.

Workers’ Compensation Insurance Provides Financial Protection to Employees

The leading cause of workers’ comp death claims is traffic accidents that occur when the employee is in a work vehicle. Work-related injuries from falls, being struck by an object, and electrocutions are also common.

In addition to the death benefits that workers’ compensation insurance provides, it also covers lost wages and medical expenses for employees who sustain any injury on the job. It can be a financial burden for businesses, which is why workers’ compensation insurance is so important.

It is Legal

In some states, providing workers’ compensation insurance is mandatory. The law requires you to provide this cover if you have employees. Failure to comply can result in hefty fines and penalties.

Additionally, you may be liable if one of your employees sustains an injury on the job and you do not have workers’ compensation insurance. It means that you could be sued by your employee and be responsible for paying their medical bills and other damages.

You may face serious charges or legal consequences if you do not adhere to your state’s workers’ compensation laws. For example, the court may penalize you, they may revoke your business license, or you may even be sent to jail.

It is important to note that workers’ compensation insurance is not health insurance. Health insurance covers medical expenses for illnesses and injuries outside of work. Workers’ compensation insurance covers medical costs for workplace injuries and illnesses.

Businesses that do not carry workers’ compensation insurance can be fined and may even face criminal charges.

It is Important for Your Employees

Your employees are your most valuable asset. They are the ones who help you grow and succeed as a business.

It can affect your business if they sustain an injury or get hurt on the job. Not only will you have to deal with the cost of medical bills, but you will also lose their productivity.

The workers’ compensation insurance can help protect your business from these costs. It can also help you attract and retain good employees. In addition, employees who know their employer has workers’ compensation insurance are more likely to feel secure in their job.

Also, Read: 7 Essential Aspects to Consider If You Plan on Starting a Fully Remote Business

How to Get the Best Workers Compensation Insurance Provider

When choosing a workers’ compensation insurance provider like https://cerity.com/solutions/workers-comp/ or any other insurance provider, you should keep a few things in mind. First, you must ensure that the provider is licensed in your state.

It is crucial to find a licensed provider because they will be up-to-date on the latest workers’ compensation laws.

Another thing to consider is whether the provider offers discounts. For example, some insurers offer discounts for safety programs, early payment, and more.

Finally, you need to ensure that the provider has a good reputation. You can check this by reading online reviews, talking to other businesses, and more.

Final Words

Workers’ compensation is essential insurance for businesses of all sizes. By understanding how it works and what it covers, you can help keep your employees safe and protected in the event of a work-related injury or illness. While workers’ compensation is not required in every state, having this coverage in place is a good idea.

The Challenges and Benefits of Removing Negative Online…

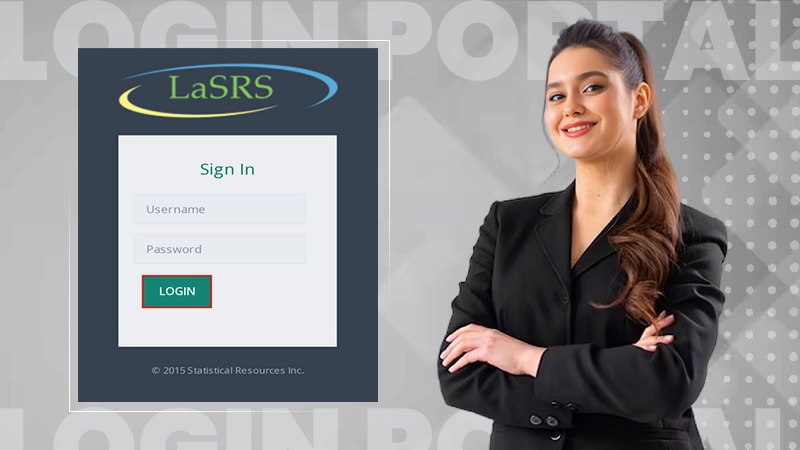

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support