Free Profit and Loss Template

Isn’t it true that every business owner wants to know if they’re profitable? With FreshBooks’ Free profit and loss template, you can easily construct P&Ls and calculate your company’s net income. With a range of accounting report forms, including the free downloadable P&L statement, you can take control of your business accounting.

What is the Profit and Loss Statement Template?

It’s critical to know whether your online venture or company is profitable. It would be best to decide whether your revenue exceeds your expenses and whether you are, in fact, good. Profit and loss statements can assist you in determining if you’re profitable or not. Expenses, revenue, and net income are the three critical elements of a profit and loss statement. The term “revenue” refers to the amount of money brought in. This is the amount that people (clients or customers) are willing to pay you. Expenses are the expenses that come with running a business. That’s how much you pay other people and companies. The difference between these two figures is your net income. Your profit is calculated by subtracting your expenses from your income. A positive or negative balance indicates if your business is profitable. As a small business owner, you’re constantly seeking new ways to improve and expand your firm. A profit and loss statement is a detailed financial report that may demonstrate to you and your investors that you can make money and where any manufacturing and operations costs are going. It displays your ability to create profit and effectively divert expenses, providing you with critical information about your company’s financial health. Our tutorial will walk you through all of the procedures you’ll need to construct your first profit and loss statement and get a clear picture of your business’s finances.

Read About: Pandora’s Box or Reliability to Check All About Paid Crypto Signals.

Why We Need a Profit and Loss Statement for Business?

It indicates to investors and lenders how much money you’ve brought in and how much you’ve spent and is a significant indicator of your company’s financial health. This enables them to determine whether your firm is successful and forecast how it will expand in the future based on its current growth rate. Not to mention that it’s a valuable tool for projecting future budgets and avoiding high costs.

A business profit and loss statement can provide you with various numbers and metrics to keep an eye on, depending on your industry. Are you in charge of a construction firm? The P&L statement will provide you with a comprehensive picture of your labor costs. Are you in charge of a restaurant? Yes, complete information shows which items sell better and whether you’re losing money on meals that no one is ordering.

What’s the Best Way to Make a Profit and Loss Statement?

Let’s look at every step you’ll need to take to precisely evaluate whether or not your company is profitable and then get to the bottom line: your net income.

1. Selecting an Income Statement Time Frame

The first step in preparing a P&L statement is deciding the period you’ll be looking at. The most typical time frames are weekly, monthly, and quarterly. As a result, consider why you require the statement. For example, a once-per-quarter statement shows you the big picture of your income and losses over a fiscal quarter. You won’t be able to keep track of any changes or identify potential concerns if you only do it once a year. Decide on a time frame and prepare profit and loss statements regularly. You can compare any changes to your business by running these reports at regular intervals.

2. Earnings

Next, add all of your business’s income/revenue to the top line of your spreadsheet. Earnings can be divided into many categories and income streams. This information can be found in your general ledger and Current Accounts Receivable.

3. The Price of the Goods Sold

Fill in the second section of the statement by calculating the cost of your raw materials, including the cost of labor to create those raw materials and any additional manufacturing charges. The profit and loss statement includes both cash and non-monetary receipts.

4. Determining Gross Profit/Loss

We’ll remove costs from total income now that we know how much money you’ve invested into your business and your revenue.

5. Charges

Operating expenses, such as travel fees, payroll, rent and real estate, office supplies, utilities and repair services, insurance, telecommunication, marketing and advertising, shipping fees, and so on, are likely to be the most extended area of this financial statement. Deduct your expenses from the gross profit you obtained in the previous step to get your earnings before taxes. You’ll see that we didn’t add investment dividends or interest income in Step 1. This is because they were added afterward. Your EBITDA is now available.

6. Taxes, amortization, depreciation, and interest

Taxes, amortization, depreciation, and interest are all factors to consider. Add any estimated taxes, amortization or depreciation on any expenses, and interest payments before determining your ultimate net earnings.

7. Getting Your Net Profits

Finally, to calculate your net income (also known as net profit), apply the following formula:

How to Change the Profit and Loss Spreadsheet (P&L Template)

All of the free Excel file templates may be altered and customized to fit your specific business needs. If you need more line items, add extra rows to the section where you’ll be entering revenue or spending information. Then double-check that the calculations that sum up the totals include the new rows. If you need to eliminate line items from the templates, delete the extra rows and double-check that all formulas are valid. Using a profit and loss template to track your company’s income and expenses will make your life easier. Everything you need is at your fingertips, including an income statement, breakeven analysis, profit and loss statement template, and a balance sheet with financial ratios.

The Challenges and Benefits of Removing Negative Online…

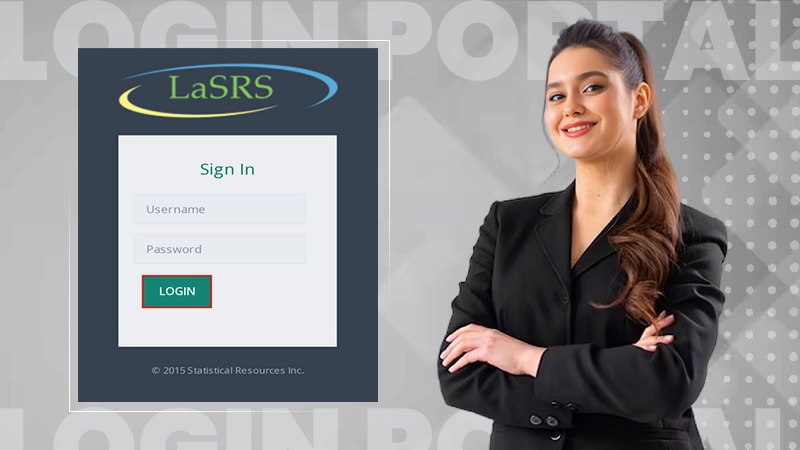

Unlock the Simplest Way to Access LaSRS Login…

Strategic Wins: How SafeOpt Can Boost Your Online…

5 Reasons Why Marketing Matters in Business?

Google Ads: What Are the Basic Checklists to…

The Crucial Role of Press Releases in a…

8 Best Tech Tips to Implement for Better…

Fax Machines in the Digital Age: A Sustainable…

Breaking Barriers: The Power of Business Translation Services

Why Do Businesses Need a Dedicated Mobile App?

The Role of Onboarding in Improving Employee Retention…

3 Major Benefits of Onsite IT Support